NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

2 posters

Page 9 of 12

Page 9 of 12 •  1, 2, 3 ... 8, 9, 10, 11, 12

1, 2, 3 ... 8, 9, 10, 11, 12

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 17 - 21 April 2017

First, a review of last week’s forecast:

- Seeing that EUR/USD had been oversold, both analysts and technical analysis expected it to bounce up, which is what happened. However, the bullish force in this case was only powerful enough to lift the pair to 1.0690 (as opposed to the expected 1.0750), after which the pair fell to the support area near 1.0610;

- A rebound of GBP/USD was expected as well. The reason for this forecast was the area of a strong medium-term support, which the pair had been near to. The height of 1.2500 was named as a target: the pair reached it in the first half of the week, and subsequently decided to take a break for almost a day. Then, having gathered its forces, it rose by another 75 points, reaching the height of 1.2575 on Thursday;

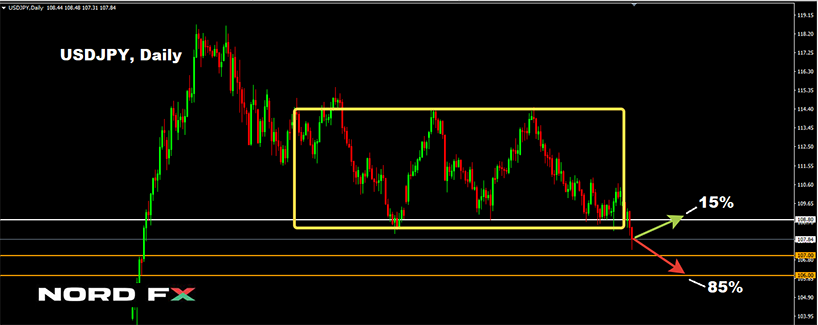

- As for the future of USD/JPY, everyone - experts, graphical analysis, and indicators - expected the pair to retest the local minimum at 110.00. The minimum did indeed turn out to be local: the pair easily overcame this barrier and fell by another 140 points by the end of the weekly session;

- USD/CHF. Here, about one quarter of analysts and graphical analysis on H4 expected that the pair would continue to move in the downward medium-term channel (this channel started in December 2016 and is clearly visible on D1 and W1), and would strive to reach its centre line in the 0.9950 area. The pair did indeed move southwards the entire week, resting on the upper boundary of the channel; it could not, however, overcome the symbolic support at 1.0000 and completed the week-long session near the 1.0050 horizon.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- EUR/USD. Here most analysts (60%), supported by nearly 90% of indicators, still side with the bears, waiting for the pair’s fall to the 1.0500 zone. An alternative point of view is expressed by graphical analysis on H4 as well as 40% of experts. According to them, the pair, whilst moving in the medium-term rising channel that began in December 2016, will first grow to 1.0690 and then by another 130 points to 1.0820;

- in the medium term, nearly 80% of experts expect a falling GBP/USD (support 1.2420, 1.2360 and 1.2110). As for the immediate future, most analysts (60%), supported by both oscillators and trend indicators, lean towards the view that the upward momentum has not yet been exhausted, and that the pair will reach at least 1.2615. The next resistance is at 1.2375;

- there is a discrepancy between the weekly and medium-term forecasts for USD/JPY as well. So, if in the short term, 70% of analysts speak of the continuation of the downward trend to 107.50-107.85, the monthly and quarterly forecasts point northwards. The targets remain the same: 112.00 and 113.55. As for technical analysis, here the forces are distributed in the following way: graphical analysis on D1, 100% of trend indicators and 95% of oscillators side with the bears. On the side of the bulls, 5% of the oscillators that fix the extent of the pair’s overselling and graphical analysis on H4 both predict its growth to 110.50;

- USD/CHF. For the week to come, half of the analysts, along with graphical analysis and trend indicators on H4, expect the pair to move in the lateral channel of 1.0008-1.0100. The other half of experts, supported by the oscillators on H4, vote for its descent into the 0.9980 zone. As for the medium-term forecast, here almost 60% of analysts look northwards to 1.0170. Both oscillators and trend indicators on D1 agree with this point of view.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

https://youtu.be/hNFt_02SUuI

First, a review of last week’s forecast:

- Seeing that EUR/USD had been oversold, both analysts and technical analysis expected it to bounce up, which is what happened. However, the bullish force in this case was only powerful enough to lift the pair to 1.0690 (as opposed to the expected 1.0750), after which the pair fell to the support area near 1.0610;

- A rebound of GBP/USD was expected as well. The reason for this forecast was the area of a strong medium-term support, which the pair had been near to. The height of 1.2500 was named as a target: the pair reached it in the first half of the week, and subsequently decided to take a break for almost a day. Then, having gathered its forces, it rose by another 75 points, reaching the height of 1.2575 on Thursday;

- As for the future of USD/JPY, everyone - experts, graphical analysis, and indicators - expected the pair to retest the local minimum at 110.00. The minimum did indeed turn out to be local: the pair easily overcame this barrier and fell by another 140 points by the end of the weekly session;

- USD/CHF. Here, about one quarter of analysts and graphical analysis on H4 expected that the pair would continue to move in the downward medium-term channel (this channel started in December 2016 and is clearly visible on D1 and W1), and would strive to reach its centre line in the 0.9950 area. The pair did indeed move southwards the entire week, resting on the upper boundary of the channel; it could not, however, overcome the symbolic support at 1.0000 and completed the week-long session near the 1.0050 horizon.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- EUR/USD. Here most analysts (60%), supported by nearly 90% of indicators, still side with the bears, waiting for the pair’s fall to the 1.0500 zone. An alternative point of view is expressed by graphical analysis on H4 as well as 40% of experts. According to them, the pair, whilst moving in the medium-term rising channel that began in December 2016, will first grow to 1.0690 and then by another 130 points to 1.0820;

- in the medium term, nearly 80% of experts expect a falling GBP/USD (support 1.2420, 1.2360 and 1.2110). As for the immediate future, most analysts (60%), supported by both oscillators and trend indicators, lean towards the view that the upward momentum has not yet been exhausted, and that the pair will reach at least 1.2615. The next resistance is at 1.2375;

- there is a discrepancy between the weekly and medium-term forecasts for USD/JPY as well. So, if in the short term, 70% of analysts speak of the continuation of the downward trend to 107.50-107.85, the monthly and quarterly forecasts point northwards. The targets remain the same: 112.00 and 113.55. As for technical analysis, here the forces are distributed in the following way: graphical analysis on D1, 100% of trend indicators and 95% of oscillators side with the bears. On the side of the bulls, 5% of the oscillators that fix the extent of the pair’s overselling and graphical analysis on H4 both predict its growth to 110.50;

- USD/CHF. For the week to come, half of the analysts, along with graphical analysis and trend indicators on H4, expect the pair to move in the lateral channel of 1.0008-1.0100. The other half of experts, supported by the oscillators on H4, vote for its descent into the 0.9980 zone. As for the medium-term forecast, here almost 60% of analysts look northwards to 1.0170. Both oscillators and trend indicators on D1 agree with this point of view.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

https://youtu.be/hNFt_02SUuI

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 24-28 April 2017

First, a review of last week’s forecast:

- In the opinion of almost half of the experts (40%), supported by graphical analysis on H4, the pair EUR/USD, which has been moving in the medium-term rising channel that began in December 2016, had been expected to rise to 1.0690, and then by yet another 130 points. It turned out that the pair indeed immediately went northwards, starting from Monday; on Tuesday, it broke through the resistance at 1.0690 and, having turned it into a support level, the pair reached 1.0780. After this, the bulls’ energy dried up, and the pair returned to the 1.0690 zone by the end of the week’s session;

- A rebound had been expected for GBP/USD. Most analysts, supported by oscillators and trend indicators, had been inclined towards the view that the pair’s upward propulsion had not yet been exhausted and that it could reach the height of 1.2705. Not many expected the powerful support British Prime Minister Teresa May gave the bulls in announcing snap parliamentary elections. Because of such support, the pair soared almost 400 points, only stopping at 1.2904. After that, it turned and slowly descended to the strong Pivot level which the pair has been fluctuating since June 2016;

- USD/JPY. Here there was a discrepancy between the weekly and the medium-term forecasts: the former pointed southwards, the latter to the north. As a result, the pair moved in the side channel 108.10 -109.20 for almost the entire week, dominated slightly by bullish trends. It was the bulls who tried to break the upper boundary of this channel at the end of the week. However, this breakthrough was unsuccessful, since, having risen by only 30 points, the pair quickly returned to the sideways corridor;

- Unlike EUR/USD, USD/CHF reacted rather violently to the British Prime Minister’s announcement. Whilst half of the experts along with the oscillators had expected its fall to the level of 0.9980, in reality the local minimum ended up being 40 points lower. However, the pair "changed its mind" afterwards and returned to where the analysts had indicated: the zone 0.9980.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made based on a wide variety of technical and graphical analysis methods, we can say the following:

- The ECB and the Bank of Japan rate decisions should prove unsurprising. The presidential elections in France, however, may cause increased volatility. It is also possible, though, that there will be no sharp exchange rate jumps, especially if the vote reaches the second round. Uncertainty related to these elections has led to uncertainty in experts’ opinions. Thus, in giving their weekly forecast for EUR/USD, one third of them thought the pair will grow, one third has spoken of a fall and one third of a sideways trend. If we now turn to the medium-term forecast, here already 65% of experts, supported by graphical analysis, vote for the pair falling, indicating 1.0500 and 1.0350 as target levels. An alternative view is represented by 35% of analysts and indicators on D1, according to which the pair must return to the highs of February-March 2017;

- In the medium term, nearly 85% of experts continue to expect GBP/USD to fall (support levels are 1.2575, 1.2490, 1.2365). As for the immediate future, the situation is different: only 30% of analysts vote for its fall. The others expect it to return to the previous week’s highs and to fix in the 1.2900-1.3000 area. Both graphical analysis on H4, and indicators on D1 agree with this prospect. Only 10% of oscillators yet indicate that the pair is overbought;

- There still remains an obvious discrepancy between the week-long and medium-term forecasts for USD/JPY as well. So, if in the short term 60% of analysts speak about its fall, the monthly and quarterly forecasts are oriented northwards. The targets are the same: 112.00 and 113.55. As for technical analysis, graphical analysis and oscillators on H4 show the continuation of the pair's lateral movement in the 108.30-109.50 channel;

- Regarding USD/CHF, the battle here is between experts and indicators. 80% of analysts believe that the pair is sure to grow to the 1.0000-1.0100 zone, and 85% of oscillators and trend indicators on D1 expect it to drop. A compromise is offered by graphical analysis, which points first to the growth of the pair to 1.0050 and then to its fall to the local minimum of 0.9940.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

https://youtu.be/hNFt_02SUuI

First, a review of last week’s forecast:

- In the opinion of almost half of the experts (40%), supported by graphical analysis on H4, the pair EUR/USD, which has been moving in the medium-term rising channel that began in December 2016, had been expected to rise to 1.0690, and then by yet another 130 points. It turned out that the pair indeed immediately went northwards, starting from Monday; on Tuesday, it broke through the resistance at 1.0690 and, having turned it into a support level, the pair reached 1.0780. After this, the bulls’ energy dried up, and the pair returned to the 1.0690 zone by the end of the week’s session;

- A rebound had been expected for GBP/USD. Most analysts, supported by oscillators and trend indicators, had been inclined towards the view that the pair’s upward propulsion had not yet been exhausted and that it could reach the height of 1.2705. Not many expected the powerful support British Prime Minister Teresa May gave the bulls in announcing snap parliamentary elections. Because of such support, the pair soared almost 400 points, only stopping at 1.2904. After that, it turned and slowly descended to the strong Pivot level which the pair has been fluctuating since June 2016;

- USD/JPY. Here there was a discrepancy between the weekly and the medium-term forecasts: the former pointed southwards, the latter to the north. As a result, the pair moved in the side channel 108.10 -109.20 for almost the entire week, dominated slightly by bullish trends. It was the bulls who tried to break the upper boundary of this channel at the end of the week. However, this breakthrough was unsuccessful, since, having risen by only 30 points, the pair quickly returned to the sideways corridor;

- Unlike EUR/USD, USD/CHF reacted rather violently to the British Prime Minister’s announcement. Whilst half of the experts along with the oscillators had expected its fall to the level of 0.9980, in reality the local minimum ended up being 40 points lower. However, the pair "changed its mind" afterwards and returned to where the analysts had indicated: the zone 0.9980.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made based on a wide variety of technical and graphical analysis methods, we can say the following:

- The ECB and the Bank of Japan rate decisions should prove unsurprising. The presidential elections in France, however, may cause increased volatility. It is also possible, though, that there will be no sharp exchange rate jumps, especially if the vote reaches the second round. Uncertainty related to these elections has led to uncertainty in experts’ opinions. Thus, in giving their weekly forecast for EUR/USD, one third of them thought the pair will grow, one third has spoken of a fall and one third of a sideways trend. If we now turn to the medium-term forecast, here already 65% of experts, supported by graphical analysis, vote for the pair falling, indicating 1.0500 and 1.0350 as target levels. An alternative view is represented by 35% of analysts and indicators on D1, according to which the pair must return to the highs of February-March 2017;

- In the medium term, nearly 85% of experts continue to expect GBP/USD to fall (support levels are 1.2575, 1.2490, 1.2365). As for the immediate future, the situation is different: only 30% of analysts vote for its fall. The others expect it to return to the previous week’s highs and to fix in the 1.2900-1.3000 area. Both graphical analysis on H4, and indicators on D1 agree with this prospect. Only 10% of oscillators yet indicate that the pair is overbought;

- There still remains an obvious discrepancy between the week-long and medium-term forecasts for USD/JPY as well. So, if in the short term 60% of analysts speak about its fall, the monthly and quarterly forecasts are oriented northwards. The targets are the same: 112.00 and 113.55. As for technical analysis, graphical analysis and oscillators on H4 show the continuation of the pair's lateral movement in the 108.30-109.50 channel;

- Regarding USD/CHF, the battle here is between experts and indicators. 80% of analysts believe that the pair is sure to grow to the 1.0000-1.0100 zone, and 85% of oscillators and trend indicators on D1 expect it to drop. A compromise is offered by graphical analysis, which points first to the growth of the pair to 1.0050 and then to its fall to the local minimum of 0.9940.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

https://youtu.be/hNFt_02SUuI

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 01 - 05 May 2017

First, a review of last week’s forecast:

- When giving the forecast for EUR/USD, 35% of experts and indicators on D1 insisted that it should return to the highs of February and March 2017. This is what happened in response to the first round of the French presidential elections. Having established an impressive gap at the opening of the weekly session, the pair rose to 1.0900, where it spent the whole week, turning this level into a Power Point;

- after an inspiring leap upwards on 18 March, GBP/USD reacted calmly to the elections in France: there were no gaps and, instead, there was a smooth increase by 180 points during the week. The roots of this growth are at the support at 1.2775, which used to be the upper limit of six-month long side channel;

- The French elections tsunami has reached the Japanese islands and has swept USD/JPY towards a strong medium-term support / resistance level around 111.60. It should be noted that analysts have long expected the growth of the pair to 112.00, to which it came very close: it checked out on Wednesday at the height of 111.77;

- The gap at the beginning of the week gave additional strength to the bears. Hence, the pair USD/CHF continued its downward trend, which began on April 10. The pair fell by almost 100 points, reaching the local bottom at 0.9893, and then it turned and finished the week at the level of 0.9950.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made based on a wide variety of technical and graphical analysis methods, we can say the following:

- Regarding the indicators, in predicting the future of the EUR/USD, more than 80% of them are oriented northwards, pointing to 1.1120 as the target height. However, one third of oscillators on D1 have already indicated that the pair is overbought. Expert opinions regarding its nearest future are almost equally divided: 35% foresee the growth of the pair, 30% anticipate its fall and 35% predict a sideways trend. But in the medium term, the picture is quite different: here, 80% of experts vote for the fall of the pair to an initial support 1.0680 and a subsequent one of 1.0570;

- GBP/USD. It is for the second week running that the pair moves in the corridor that separates the two side channels: the upper one of July-October 2016, and lower one of October 2016 - April 2017. 65% of the experts believe that the pair will be unable to overcome the resistance of 1.3055 and will return to the channel’s lower boundary as early as in the first half of May. Support levels are 1.2570, 1.2375 and 1.2130. An alternative point of view is supported by 35% of analysts who predict that the immediate goals for the pair are 1.3370 and 1.3445. As for the graphical analysis, on H4 it points to a sideways trend in the range of 1.2775-1.3055;

- USD/JPY. Finally, analysts' opinions are aligned with the indicator readings, and more than 80% of them predict a continuation of the upward trend for this pair. The main goals are 113.55 and 115.50. This does not exclude a short-term slide of the pair to the 110.00 horizon;

- as often happens, the future of USD/CHF represents a mirror image of the EUR/USD. And if, in the short term, 75% of experts speak about the continuation of the downward trend, when giving a medium-term forecast 70% of them see growth. There are support levels at 0.9920, 0.9890 and 0.9820. The target heights are 1.0000 and 1.0100. As for graphical analysis, on H4 it points to the growth of the pair to 1.0040 in the coming days.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

First, a review of last week’s forecast:

- When giving the forecast for EUR/USD, 35% of experts and indicators on D1 insisted that it should return to the highs of February and March 2017. This is what happened in response to the first round of the French presidential elections. Having established an impressive gap at the opening of the weekly session, the pair rose to 1.0900, where it spent the whole week, turning this level into a Power Point;

- after an inspiring leap upwards on 18 March, GBP/USD reacted calmly to the elections in France: there were no gaps and, instead, there was a smooth increase by 180 points during the week. The roots of this growth are at the support at 1.2775, which used to be the upper limit of six-month long side channel;

- The French elections tsunami has reached the Japanese islands and has swept USD/JPY towards a strong medium-term support / resistance level around 111.60. It should be noted that analysts have long expected the growth of the pair to 112.00, to which it came very close: it checked out on Wednesday at the height of 111.77;

- The gap at the beginning of the week gave additional strength to the bears. Hence, the pair USD/CHF continued its downward trend, which began on April 10. The pair fell by almost 100 points, reaching the local bottom at 0.9893, and then it turned and finished the week at the level of 0.9950.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made based on a wide variety of technical and graphical analysis methods, we can say the following:

- Regarding the indicators, in predicting the future of the EUR/USD, more than 80% of them are oriented northwards, pointing to 1.1120 as the target height. However, one third of oscillators on D1 have already indicated that the pair is overbought. Expert opinions regarding its nearest future are almost equally divided: 35% foresee the growth of the pair, 30% anticipate its fall and 35% predict a sideways trend. But in the medium term, the picture is quite different: here, 80% of experts vote for the fall of the pair to an initial support 1.0680 and a subsequent one of 1.0570;

- GBP/USD. It is for the second week running that the pair moves in the corridor that separates the two side channels: the upper one of July-October 2016, and lower one of October 2016 - April 2017. 65% of the experts believe that the pair will be unable to overcome the resistance of 1.3055 and will return to the channel’s lower boundary as early as in the first half of May. Support levels are 1.2570, 1.2375 and 1.2130. An alternative point of view is supported by 35% of analysts who predict that the immediate goals for the pair are 1.3370 and 1.3445. As for the graphical analysis, on H4 it points to a sideways trend in the range of 1.2775-1.3055;

- USD/JPY. Finally, analysts' opinions are aligned with the indicator readings, and more than 80% of them predict a continuation of the upward trend for this pair. The main goals are 113.55 and 115.50. This does not exclude a short-term slide of the pair to the 110.00 horizon;

- as often happens, the future of USD/CHF represents a mirror image of the EUR/USD. And if, in the short term, 75% of experts speak about the continuation of the downward trend, when giving a medium-term forecast 70% of them see growth. There are support levels at 0.9920, 0.9890 and 0.9820. The target heights are 1.0000 and 1.0100. As for graphical analysis, on H4 it points to the growth of the pair to 1.0040 in the coming days.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 08 - 12 May 2017

First, a review of last week’s forecast:

- Recall that the experts’ opinions on EUR/USD a week ago were divided almost equally: 35% supported the growth of the pair, 30% voted for its fall and 35% foresaw a sideways trend. At the same time, more than 80% of indicators were oriented to the north: they turned out to be right. The ECB President Mario Draghi' s speech, coupled with optimism about the second round of elections in France, provided the euro with such strong support that this pair chose to ignore even very positive data on the US labour market published on Friday 5 May. Thus, the pair finished the week session near 1.1000, having risen by about 100 points in five days;

- GBP/USD. 65% of experts, together with graphical analysis on H4, suggested that the pair would fail to overcome the resistance of 1.3055 and would stay in the side channel 1.2775-1.3055 for the entire week. This forecast proved to be quite accurate, although the pair's fluctuations proved even more sluggish than expected: as a result, the pair did not even manage to leave the 1.2830-1.2983 range;

- The forecast for the future of USD/JPY was surprising because of the fact that analysts' opinions coincided with indicator readings, which was something we had not seen for quite some time: more than 80% of them predicted a continuation of the uptrend for this pair. The forecast was 100% correct. Already on Thursday, having risen by 185 points, the pair managed to reach 113.00;

- The forecast for USD/CHF also turned out to be correct. The absolute majority of experts (75%) insisted on the continuation of the downtrend, identifying the levels of 0.9890 and 0.9820 as support levels. Thus, the pair fixed the local bottom near the middle of this range at 0.9858, and finished the week session at 0.9870.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- The forecast for EUR/USD resembles the one that was given last week. More than 90% of indicators point northwards, while at the same time one third of oscillators on D1 signal the pair is overbought. As for analysts, a good 65% of them believe that the pair will try to secure a position above 1.0930 and 1.0850. And, just like last week, the medium-term forecast directly opposes the weekly one: here more than 60% of experts still expect the pair to fall into the 1.0400-1.0600 zone;

- Analysts express a similar opinion about the future of GBP/USD. The forecast for the coming days is as follows: 60% predict the growth of the pair, 40% predict its fall. The medium-term forecast, meanwhile, has 75% standing behind the fall of the pair and only 25% foreseeing its growth. Graphical analysis and almost 80% of trend indicators and oscillators agree with both the short and medium-term outlooks. The target for the coming days is the 1.3100-1.3150 zone, and the support levels are 1.2835 and 1.2770. In the medium term, we can expect a drop to the levels of 1.2570, 1.2375 and 1.2130;

- USD/JPY. The majority (60%) of experts believe that, seeing as the pair has reached the upper boundary of the descending channel that began at the end of December 2016, it should now be expected to descend. Graphical analysis on H4 and D1 agrees with such a forecast: according to its readings, the pair can fall first to 111.55, and then, after a short rebound, even further southwards to the 108.50 mark. An alternative point of view is represented by 40% of experts who, along with the indicators, expect the pair to grow to 115.00;

- Once again, the future of USD/CHF is expected to be a mirror image of EUR/USD: it will first go southwards to the support level of 0.9800, and then perform a 180-degree turn in order to return to the 1.0000-1.0100 zone. This scenario is supported by about 70% of analysts. However, in addition to the elections in France, whose results we expect to be announced on Monday, the second half of the week will also be filled with important economic and political events that are likely to affect the world’s major currencies. Thus, the most pessimistic forecast for the US dollar, supported by 30% of experts, does not exclude the fall of USD/CHF to 0.9550.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

First, a review of last week’s forecast:

- Recall that the experts’ opinions on EUR/USD a week ago were divided almost equally: 35% supported the growth of the pair, 30% voted for its fall and 35% foresaw a sideways trend. At the same time, more than 80% of indicators were oriented to the north: they turned out to be right. The ECB President Mario Draghi' s speech, coupled with optimism about the second round of elections in France, provided the euro with such strong support that this pair chose to ignore even very positive data on the US labour market published on Friday 5 May. Thus, the pair finished the week session near 1.1000, having risen by about 100 points in five days;

- GBP/USD. 65% of experts, together with graphical analysis on H4, suggested that the pair would fail to overcome the resistance of 1.3055 and would stay in the side channel 1.2775-1.3055 for the entire week. This forecast proved to be quite accurate, although the pair's fluctuations proved even more sluggish than expected: as a result, the pair did not even manage to leave the 1.2830-1.2983 range;

- The forecast for the future of USD/JPY was surprising because of the fact that analysts' opinions coincided with indicator readings, which was something we had not seen for quite some time: more than 80% of them predicted a continuation of the uptrend for this pair. The forecast was 100% correct. Already on Thursday, having risen by 185 points, the pair managed to reach 113.00;

- The forecast for USD/CHF also turned out to be correct. The absolute majority of experts (75%) insisted on the continuation of the downtrend, identifying the levels of 0.9890 and 0.9820 as support levels. Thus, the pair fixed the local bottom near the middle of this range at 0.9858, and finished the week session at 0.9870.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- The forecast for EUR/USD resembles the one that was given last week. More than 90% of indicators point northwards, while at the same time one third of oscillators on D1 signal the pair is overbought. As for analysts, a good 65% of them believe that the pair will try to secure a position above 1.0930 and 1.0850. And, just like last week, the medium-term forecast directly opposes the weekly one: here more than 60% of experts still expect the pair to fall into the 1.0400-1.0600 zone;

- Analysts express a similar opinion about the future of GBP/USD. The forecast for the coming days is as follows: 60% predict the growth of the pair, 40% predict its fall. The medium-term forecast, meanwhile, has 75% standing behind the fall of the pair and only 25% foreseeing its growth. Graphical analysis and almost 80% of trend indicators and oscillators agree with both the short and medium-term outlooks. The target for the coming days is the 1.3100-1.3150 zone, and the support levels are 1.2835 and 1.2770. In the medium term, we can expect a drop to the levels of 1.2570, 1.2375 and 1.2130;

- USD/JPY. The majority (60%) of experts believe that, seeing as the pair has reached the upper boundary of the descending channel that began at the end of December 2016, it should now be expected to descend. Graphical analysis on H4 and D1 agrees with such a forecast: according to its readings, the pair can fall first to 111.55, and then, after a short rebound, even further southwards to the 108.50 mark. An alternative point of view is represented by 40% of experts who, along with the indicators, expect the pair to grow to 115.00;

- Once again, the future of USD/CHF is expected to be a mirror image of EUR/USD: it will first go southwards to the support level of 0.9800, and then perform a 180-degree turn in order to return to the 1.0000-1.0100 zone. This scenario is supported by about 70% of analysts. However, in addition to the elections in France, whose results we expect to be announced on Monday, the second half of the week will also be filled with important economic and political events that are likely to affect the world’s major currencies. Thus, the most pessimistic forecast for the US dollar, supported by 30% of experts, does not exclude the fall of USD/CHF to 0.9550.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 15 - 19 May 2017

First, a review of last week’s forecast:

- Recall that the experts' forecasts regarding the behaviour of EUR/USD in the short and medium term were fully opposed. Thus, in the first case, most of them favoured the growth of the pair, whilst in the second they favoured its fall. And, as it often happens, the medium-term forecast turned out to be the most accurate: until Thursday, the pair moved in a downtrend, losing more than 180 points over this period. However, on Friday, data on retail sales in the US was released, which played into the hands of bulls: instead of the expected 0.6%, consumer spending growth was only 0.4%: as a result, the pair drastically launched northwards and froze near the strong medium-term resistance line at 1.0932;

- A similar discrepancy among analysts was observed with respect to the future of GBP/USD. Apart from that, it was projected that the nearest support was at the level of 1.2835, and the resistance was 1.3100. However, just like two weeks ago, the pair ended up behaving more calmly than expected; it stayed within 1.2843-1.2986;

- For almost two months we have been stating in each of our forecasts for USD/JPY that experts are expecting its return first to 113.55, and then to 115.00. The pair has finally conquered the first of these heights and came close to the second one, reaching 114.36 just this week. After this victory, the strength of the bulls dried up, and the pair retreated downwards by 100 points, finishing the week at 113.35;

- An absolute majority (70%) of analysts expected the pair USD/CHF to return to the 1.0000-1.0100 zone. This forecast turned out to be 100% true: the maximum of this week ended up being 1.0098, and the pair met the end of the week’s session at 1.0007.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- EUR/USD. The calendar for the upcoming week is not marked by any special economic or political events. This might be the reason why more than 50% of analysts, supported by almost half of the oscillators at D1, predict a lateral movement of this pair. The second fairly large group of experts (about 40%) believes that the pair will again test the height of 1.1000. 10% of experts still believe, though, that the pair will immediately head to the south. Interestingly, their point of view is supported by graphical analysis and almost half of the oscillators on H4, which indicate that this pair is overbought. Moreover, in the medium term, 65% of analysts expect it to fall. The nearest support is 1.0850, the medium-term goal is to return to the 1.0500-1.0680 zone;

- As for the future of GBP/USD, here the trend indicators on D1 insist on the continuation of the sluggish-upward trend, which began in the last decade of April. 30% of experts agree with this point of view, believing that the pair must necessarily break the 1.3000 barrier. An alternative point of view is represented by 70% of analysts, 60% of trend indicators and 90% of oscillators on H4. All of them insist it is best to start selling this pair and suggest the nearest support is 1.2755. If we look at the medium-term forecast, the number of bear supporters among the analysts already exceeds 80%; 1.2100 is declared the main target.

- USD/JPY. After this pair’s impressive spurt upwards in the first half of last week and a sufficiently strong retracement in the second, the indicator readings turned out to be diametrically opposite: on D1, they recommend buying the pair, whilst on H4 they recommend selling. Analysts cannot come to any consensus either: one third of them predict the fall of the pair, another third its growth, and the remaining third foresee a sideways trend. At the same time, about 60% of experts believe that, leaning against the support in the 111.60-111.79 zone, the pair still should try to conquer the height of 115.50 in the next few weeks;

- The last pair of our review, as usual, is USD/CHF. Just like its chart for the past week ended up being similar to the USD/JPY chart, so are the forecasts of the indicators regarding its future: D1 advises to buy and H4 advises selling. As for the experts and graphical analysis, in their opinion, the pair will first have to drop to the 0.9940-0.9960 zone, then claw its way back to 0.9990, before finally returning to the 1.0050-1.0100 area once again.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

First, a review of last week’s forecast:

- Recall that the experts' forecasts regarding the behaviour of EUR/USD in the short and medium term were fully opposed. Thus, in the first case, most of them favoured the growth of the pair, whilst in the second they favoured its fall. And, as it often happens, the medium-term forecast turned out to be the most accurate: until Thursday, the pair moved in a downtrend, losing more than 180 points over this period. However, on Friday, data on retail sales in the US was released, which played into the hands of bulls: instead of the expected 0.6%, consumer spending growth was only 0.4%: as a result, the pair drastically launched northwards and froze near the strong medium-term resistance line at 1.0932;

- A similar discrepancy among analysts was observed with respect to the future of GBP/USD. Apart from that, it was projected that the nearest support was at the level of 1.2835, and the resistance was 1.3100. However, just like two weeks ago, the pair ended up behaving more calmly than expected; it stayed within 1.2843-1.2986;

- For almost two months we have been stating in each of our forecasts for USD/JPY that experts are expecting its return first to 113.55, and then to 115.00. The pair has finally conquered the first of these heights and came close to the second one, reaching 114.36 just this week. After this victory, the strength of the bulls dried up, and the pair retreated downwards by 100 points, finishing the week at 113.35;

- An absolute majority (70%) of analysts expected the pair USD/CHF to return to the 1.0000-1.0100 zone. This forecast turned out to be 100% true: the maximum of this week ended up being 1.0098, and the pair met the end of the week’s session at 1.0007.

***

Forecast for the coming week:

Summarizing the views of a number of analysts from leading banks and brokerage firms, as well as the forecasts made on the basis of a wide variety of technical and graphical analysis methods, we can say the following:

- EUR/USD. The calendar for the upcoming week is not marked by any special economic or political events. This might be the reason why more than 50% of analysts, supported by almost half of the oscillators at D1, predict a lateral movement of this pair. The second fairly large group of experts (about 40%) believes that the pair will again test the height of 1.1000. 10% of experts still believe, though, that the pair will immediately head to the south. Interestingly, their point of view is supported by graphical analysis and almost half of the oscillators on H4, which indicate that this pair is overbought. Moreover, in the medium term, 65% of analysts expect it to fall. The nearest support is 1.0850, the medium-term goal is to return to the 1.0500-1.0680 zone;

- As for the future of GBP/USD, here the trend indicators on D1 insist on the continuation of the sluggish-upward trend, which began in the last decade of April. 30% of experts agree with this point of view, believing that the pair must necessarily break the 1.3000 barrier. An alternative point of view is represented by 70% of analysts, 60% of trend indicators and 90% of oscillators on H4. All of them insist it is best to start selling this pair and suggest the nearest support is 1.2755. If we look at the medium-term forecast, the number of bear supporters among the analysts already exceeds 80%; 1.2100 is declared the main target.

- USD/JPY. After this pair’s impressive spurt upwards in the first half of last week and a sufficiently strong retracement in the second, the indicator readings turned out to be diametrically opposite: on D1, they recommend buying the pair, whilst on H4 they recommend selling. Analysts cannot come to any consensus either: one third of them predict the fall of the pair, another third its growth, and the remaining third foresee a sideways trend. At the same time, about 60% of experts believe that, leaning against the support in the 111.60-111.79 zone, the pair still should try to conquer the height of 115.50 in the next few weeks;

- The last pair of our review, as usual, is USD/CHF. Just like its chart for the past week ended up being similar to the USD/JPY chart, so are the forecasts of the indicators regarding its future: D1 advises to buy and H4 advises selling. As for the experts and graphical analysis, in their opinion, the pair will first have to drop to the 0.9940-0.9960 zone, then claw its way back to 0.9990, before finally returning to the 1.0050-1.0100 area once again.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

US Confidence TRUMPed: EUR/USD 1.16, US Markets Fall 10%

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 22 - 26 May 2017. But first, a few words about what happened last week:

Experts and technical analysis make predictions. Politicians shape reality and last week made this very clear. The last few days "presented" the world with several scandals related to US President Donald Trump. This was the firing of the FBI Director James Comey, the related controversy around the possible transfer of confidential information by Trump to the Russian diplomats, and subsequent rumours of Trump’s possible impeachment ...

All this resulted in a sharp weakening of the dollar and the fall of the US stock market. Suffice to say that, according to Bloomberg, over the past few days, businessmen from the 500 world richest people list became poorer by $ 35 billion.

- Huge losses were suffered by those who believed the dollar would rise and held short positions in the pair EUR/USD. Beginning on 11 May, the pair made a dizzying take-off of almost 375 points, all without any correction or rebound. It was only on Thursday 18 May, that it gave the "bears" the smallest reason for hope. However, it still proceeded to fly up 135 points and completed the five-day period at 1.1207;

- As for GBP/USD, this pair behaved much more calmly compared to the single European currency. The growth of the pair comprised only 160 points, which fully fits into its weekly framework. This growth had been predicted by 30% of experts and trend indicators, who insisted that it should overcome the 1.3000 level. This indeed ended up happening - the pair finished the week session at 1.3035.

- Whilst the British Isles have withstood the tsunami that came from the US and emerged composed, another set of islands far to the east – Japan - experienced a much larger wave: USD/JPY lost about 360 points. Even though at the very end of the week the bulls did manage to claw back about 100 points, the pair nevertheless rolled back into the zone where it was in late March and early April this year;

- It is common knowledge that USD/CHF often mirrors the fluctuations of EUR/USD. This happened this time as well, with the only difference that, unlike the European currency, the Swiss franc did not allow itself any corrections and continuously grew all week, having won about 285 points from the US dollar.

***

Forecast for the coming week:

There is a very high chance that in the coming week the movement of major currencies will be determined not only by technical analysis, but by the fundamental forces of global politics and economics. That's why this time we have focused on the forecasts given not by indicators and charts, but by experts from a number of leading world banks and brokerage companies:

- It is clear that 100% trend indicators show the growth of the EUR/USD pair. At the same time, one third of the oscillators on H4 and D1 signal that it is overbought. Approximately 70% analysts agree with them, expecting the pair to return to at least the level of 1.1080. As for the medium-term forecast, here 80% of analysts expect the pair to fall to the 1.0600-1.0670 zone.

Yet, there also exists is another point of view. For example, experts from the major French bank Credit Agricole believe that the euro is undervalued and has a high chance of growing until the quotes of EUR/USD rise to 1.15-1.16.

These analysts are echoed by specialists from Bridgewater Associates, one of the world’s largest hedge funds. They suggest that in the event of Donald Trump's impeachment, the probability of which is currently priced at 50%, the shares of leading US companies’ may fall by over 10%.

- As for the future of GBP/USD, the analysts' forecast looks like this: about 25% of experts believe the pair will be able to rise and gain a foothold above 1.3170. Most experts (75%), however, tend to the view that the pair should return to 1.2365-1.2570 over the next few weeks;

- USD/JPY. Regarding the pair’s behaviour next week, 80% of experts, along with graphic analysis on H4, expect this pair to descend to support in the 110.00 zone and further move in the side channel 110.00-111.60. However, if you extend the forecast by two or three months, the picture shifts completely to the opposite. On this time horizon, most analysts (65%) believe that the pair should return to an uptrend and once again rush to attack the height of 115.50;

- The last pair of our review is USD/CHF. Expert opinion here is divided as follows: 60% believe that the pair will continue to fall and reach the local bottom at 0.9650; the remaining 40% are guided by the fact that the pair is currently in the lower boundary of the medium-term down channel, which began in the early days of January 2016 and is clearly visible on the D1 and W1 charts. This gives a reason to expect the pair to turn and rebound to the middle line of the channel in the 0.9900 area, and then to its upper border at 1.0000. It should be noted that, in the medium term, about 70% experts agree with this view of events. However, as we wrote at the beginning of the forecast, much will depend on how tight the relationship between Donald Trump and the US Congress will actually prove to be.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 22 - 26 May 2017. But first, a few words about what happened last week:

Experts and technical analysis make predictions. Politicians shape reality and last week made this very clear. The last few days "presented" the world with several scandals related to US President Donald Trump. This was the firing of the FBI Director James Comey, the related controversy around the possible transfer of confidential information by Trump to the Russian diplomats, and subsequent rumours of Trump’s possible impeachment ...

All this resulted in a sharp weakening of the dollar and the fall of the US stock market. Suffice to say that, according to Bloomberg, over the past few days, businessmen from the 500 world richest people list became poorer by $ 35 billion.

- Huge losses were suffered by those who believed the dollar would rise and held short positions in the pair EUR/USD. Beginning on 11 May, the pair made a dizzying take-off of almost 375 points, all without any correction or rebound. It was only on Thursday 18 May, that it gave the "bears" the smallest reason for hope. However, it still proceeded to fly up 135 points and completed the five-day period at 1.1207;

- As for GBP/USD, this pair behaved much more calmly compared to the single European currency. The growth of the pair comprised only 160 points, which fully fits into its weekly framework. This growth had been predicted by 30% of experts and trend indicators, who insisted that it should overcome the 1.3000 level. This indeed ended up happening - the pair finished the week session at 1.3035.

- Whilst the British Isles have withstood the tsunami that came from the US and emerged composed, another set of islands far to the east – Japan - experienced a much larger wave: USD/JPY lost about 360 points. Even though at the very end of the week the bulls did manage to claw back about 100 points, the pair nevertheless rolled back into the zone where it was in late March and early April this year;

- It is common knowledge that USD/CHF often mirrors the fluctuations of EUR/USD. This happened this time as well, with the only difference that, unlike the European currency, the Swiss franc did not allow itself any corrections and continuously grew all week, having won about 285 points from the US dollar.

***

Forecast for the coming week:

There is a very high chance that in the coming week the movement of major currencies will be determined not only by technical analysis, but by the fundamental forces of global politics and economics. That's why this time we have focused on the forecasts given not by indicators and charts, but by experts from a number of leading world banks and brokerage companies:

- It is clear that 100% trend indicators show the growth of the EUR/USD pair. At the same time, one third of the oscillators on H4 and D1 signal that it is overbought. Approximately 70% analysts agree with them, expecting the pair to return to at least the level of 1.1080. As for the medium-term forecast, here 80% of analysts expect the pair to fall to the 1.0600-1.0670 zone.

Yet, there also exists is another point of view. For example, experts from the major French bank Credit Agricole believe that the euro is undervalued and has a high chance of growing until the quotes of EUR/USD rise to 1.15-1.16.

These analysts are echoed by specialists from Bridgewater Associates, one of the world’s largest hedge funds. They suggest that in the event of Donald Trump's impeachment, the probability of which is currently priced at 50%, the shares of leading US companies’ may fall by over 10%.

- As for the future of GBP/USD, the analysts' forecast looks like this: about 25% of experts believe the pair will be able to rise and gain a foothold above 1.3170. Most experts (75%), however, tend to the view that the pair should return to 1.2365-1.2570 over the next few weeks;

- USD/JPY. Regarding the pair’s behaviour next week, 80% of experts, along with graphic analysis on H4, expect this pair to descend to support in the 110.00 zone and further move in the side channel 110.00-111.60. However, if you extend the forecast by two or three months, the picture shifts completely to the opposite. On this time horizon, most analysts (65%) believe that the pair should return to an uptrend and once again rush to attack the height of 115.50;

- The last pair of our review is USD/CHF. Expert opinion here is divided as follows: 60% believe that the pair will continue to fall and reach the local bottom at 0.9650; the remaining 40% are guided by the fact that the pair is currently in the lower boundary of the medium-term down channel, which began in the early days of January 2016 and is clearly visible on the D1 and W1 charts. This gives a reason to expect the pair to turn and rebound to the middle line of the channel in the 0.9900 area, and then to its upper border at 1.0000. It should be noted that, in the medium term, about 70% experts agree with this view of events. However, as we wrote at the beginning of the forecast, much will depend on how tight the relationship between Donald Trump and the US Congress will actually prove to be.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

US Confidence TRUMPed: EUR/USD 1.16, US Markets Fall 10%

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 22 - 26 May 2017. But first, a few words about what happened last week:

Experts and technical analysis make predictions. Politicians shape reality and last week made this very clear. The last few days "presented" the world with several scandals related to US President Donald Trump. This was the firing of the FBI Director James Comey, the related controversy around the possible transfer of confidential information by Trump to the Russian diplomats, and subsequent rumours of Trump’s possible impeachment ...

All this resulted in a sharp weakening of the dollar and the fall of the US stock market. Suffice to say that, according to Bloomberg, over the past few days, businessmen from the 500 world richest people list became poorer by $ 35 billion.

- Huge losses were suffered by those who believed the dollar would rise and held short positions in the pair EUR/USD. Beginning on 11 May, the pair made a dizzying take-off of almost 375 points, all without any correction or rebound. It was only on Thursday 18 May, that it gave the "bears" the smallest reason for hope. However, it still proceeded to fly up 135 points and completed the five-day period at 1.1207;

- As for GBP/USD, this pair behaved much more calmly compared to the single European currency. The growth of the pair comprised only 160 points, which fully fits into its weekly framework. This growth had been predicted by 30% of experts and trend indicators, who insisted that it should overcome the 1.3000 level. This indeed ended up happening - the pair finished the week session at 1.3035.

- Whilst the British Isles have withstood the tsunami that came from the US and emerged composed, another set of islands far to the east – Japan - experienced a much larger wave: USD/JPY lost about 360 points. Even though at the very end of the week the bulls did manage to claw back about 100 points, the pair nevertheless rolled back into the zone where it was in late March and early April this year;

- It is common knowledge that USD/CHF often mirrors the fluctuations of EUR/USD. This happened this time as well, with the only difference that, unlike the European currency, the Swiss franc did not allow itself any corrections and continuously grew all week, having won about 285 points from the US dollar.

***

Forecast for the coming week:

There is a very high chance that in the coming week the movement of major currencies will be determined not only by technical analysis, but by the fundamental forces of global politics and economics. That's why this time we have focused on the forecasts given not by indicators and charts, but by experts from a number of leading world banks and brokerage companies:

- It is clear that 100% trend indicators show the growth of the EUR/USD pair. At the same time, one third of the oscillators on H4 and D1 signal that it is overbought. Approximately 70% analysts agree with them, expecting the pair to return to at least the level of 1.1080. As for the medium-term forecast, here 80% of analysts expect the pair to fall to the 1.0600-1.0670 zone.

Yet, there also exists is another point of view. For example, experts from the major French bank Credit Agricole believe that the euro is undervalued and has a high chance of growing until the quotes of EUR/USD rise to 1.15-1.16.

These analysts are echoed by specialists from Bridgewater Associates, one of the world’s largest hedge funds. They suggest that in the event of Donald Trump's impeachment, the probability of which is currently priced at 50%, the shares of leading US companies’ may fall by over 10%.

- As for the future of GBP/USD, the analysts' forecast looks like this: about 25% of experts believe the pair will be able to rise and gain a foothold above 1.3170. Most experts (75%), however, tend to the view that the pair should return to 1.2365-1.2570 over the next few weeks;

- USD/JPY. Regarding the pair’s behaviour next week, 80% of experts, along with graphic analysis on H4, expect this pair to descend to support in the 110.00 zone and further move in the side channel 110.00-111.60. However, if you extend the forecast by two or three months, the picture shifts completely to the opposite. On this time horizon, most analysts (65%) believe that the pair should return to an uptrend and once again rush to attack the height of 115.50;

- The last pair of our review is USD/CHF. Expert opinion here is divided as follows: 60% believe that the pair will continue to fall and reach the local bottom at 0.9650; the remaining 40% are guided by the fact that the pair is currently in the lower boundary of the medium-term down channel, which began in the early days of January 2016 and is clearly visible on the D1 and W1 charts. This gives a reason to expect the pair to turn and rebound to the middle line of the channel in the 0.9900 area, and then to its upper border at 1.0000. It should be noted that, in the medium term, about 70% experts agree with this view of events. However, as we wrote at the beginning of the forecast, much will depend on how tight the relationship between Donald Trump and the US Congress will actually prove to be.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 22 - 26 May 2017. But first, a few words about what happened last week:

Experts and technical analysis make predictions. Politicians shape reality and last week made this very clear. The last few days "presented" the world with several scandals related to US President Donald Trump. This was the firing of the FBI Director James Comey, the related controversy around the possible transfer of confidential information by Trump to the Russian diplomats, and subsequent rumours of Trump’s possible impeachment ...

All this resulted in a sharp weakening of the dollar and the fall of the US stock market. Suffice to say that, according to Bloomberg, over the past few days, businessmen from the 500 world richest people list became poorer by $ 35 billion.

- Huge losses were suffered by those who believed the dollar would rise and held short positions in the pair EUR/USD. Beginning on 11 May, the pair made a dizzying take-off of almost 375 points, all without any correction or rebound. It was only on Thursday 18 May, that it gave the "bears" the smallest reason for hope. However, it still proceeded to fly up 135 points and completed the five-day period at 1.1207;

- As for GBP/USD, this pair behaved much more calmly compared to the single European currency. The growth of the pair comprised only 160 points, which fully fits into its weekly framework. This growth had been predicted by 30% of experts and trend indicators, who insisted that it should overcome the 1.3000 level. This indeed ended up happening - the pair finished the week session at 1.3035.

- Whilst the British Isles have withstood the tsunami that came from the US and emerged composed, another set of islands far to the east – Japan - experienced a much larger wave: USD/JPY lost about 360 points. Even though at the very end of the week the bulls did manage to claw back about 100 points, the pair nevertheless rolled back into the zone where it was in late March and early April this year;

- It is common knowledge that USD/CHF often mirrors the fluctuations of EUR/USD. This happened this time as well, with the only difference that, unlike the European currency, the Swiss franc did not allow itself any corrections and continuously grew all week, having won about 285 points from the US dollar.

***

Forecast for the coming week:

There is a very high chance that in the coming week the movement of major currencies will be determined not only by technical analysis, but by the fundamental forces of global politics and economics. That's why this time we have focused on the forecasts given not by indicators and charts, but by experts from a number of leading world banks and brokerage companies:

- It is clear that 100% trend indicators show the growth of the EUR/USD pair. At the same time, one third of the oscillators on H4 and D1 signal that it is overbought. Approximately 70% analysts agree with them, expecting the pair to return to at least the level of 1.1080. As for the medium-term forecast, here 80% of analysts expect the pair to fall to the 1.0600-1.0670 zone.

Yet, there also exists is another point of view. For example, experts from the major French bank Credit Agricole believe that the euro is undervalued and has a high chance of growing until the quotes of EUR/USD rise to 1.15-1.16.

These analysts are echoed by specialists from Bridgewater Associates, one of the world’s largest hedge funds. They suggest that in the event of Donald Trump's impeachment, the probability of which is currently priced at 50%, the shares of leading US companies’ may fall by over 10%.

- As for the future of GBP/USD, the analysts' forecast looks like this: about 25% of experts believe the pair will be able to rise and gain a foothold above 1.3170. Most experts (75%), however, tend to the view that the pair should return to 1.2365-1.2570 over the next few weeks;

- USD/JPY. Regarding the pair’s behaviour next week, 80% of experts, along with graphic analysis on H4, expect this pair to descend to support in the 110.00 zone and further move in the side channel 110.00-111.60. However, if you extend the forecast by two or three months, the picture shifts completely to the opposite. On this time horizon, most analysts (65%) believe that the pair should return to an uptrend and once again rush to attack the height of 115.50;

- The last pair of our review is USD/CHF. Expert opinion here is divided as follows: 60% believe that the pair will continue to fall and reach the local bottom at 0.9650; the remaining 40% are guided by the fact that the pair is currently in the lower boundary of the medium-term down channel, which began in the early days of January 2016 and is clearly visible on the D1 and W1 charts. This gives a reason to expect the pair to turn and rebound to the middle line of the channel in the 0.9900 area, and then to its upper border at 1.0000. It should be noted that, in the medium term, about 70% experts agree with this view of events. However, as we wrote at the beginning of the forecast, much will depend on how tight the relationship between Donald Trump and the US Congress will actually prove to be.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for May 29 - June 2, 2017

First, a review of last week’s forecast:

- As we wrote last time, whilst experts and technical analysis make predictions, it is politicians that make reality. The President of the United States Donald Trump spent the past week in Europe, causing the scandals associated with him to temporarily quiet down. This led to a lull in the financial markets, which neither the OPEC meeting on Thursday 25 May or, notably, the G7 leadership meeting could shake. EUR/USD spent the whole week in the 1.1160-1.1267 side corridor, as if waiting for new events, and finished the five-day period practically in the same place where it started: at 1.1185;

- As for GBP/USD, recall that the bulk of experts (75%) voted for this pair’s fall. They ended up being right. This forecast was of a medium-term nature, so the fall of GBP/USD by 265 points (from 1.3040 to 1.2775) can be considered only a forerunner of the inception of this trend;

- As for USD/JPY, this pair, after the shocks of the second fortnight of May, decided to take a breather, just like EUR/USD. It moved in a side channel the entire week, rotating around the 111.30 Pivot Point: the precise point where it completed the week's session;

- It is common knowledge that USD/CHF often mirrors the fluctuations of EUR/USD. This exact phenomenon was observed this time: its lateral trend was restricted to the range of 0.9690-0.9775, and the pair finished in the same place it started five days prior, at 0.9744.

***

Many analysts seem to think that during all of 2017 the foreign exchange market will be shaped by the unpredictability surrounding Donald Trump’s Presidency of the United States, rather than by any of the usual economic forces.

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and broker companies, as well as forecasts made based on a variety of methods of technical and graphical analysis, we can say the following:

- If one were to draw a conclusion from conducting graphical analysis on H4, one would say that in the coming days EUR/USD expects a decline to the support at 1.1075; if it breaks though this support it would fall into the 1.1000 zone. The main resistance in this scenario would be in the 1.1270 zone. 60% of experts agree with this forecast, as do the overwhelming majority of trend indicators and oscillators on H4.

At the same time, it should be noted that on Friday the data on the US labor market (NFP) will be published: the forecasts of the NFP, a very important driving force for dollar movements, suggests a negative outlook for the US dollar. Perhaps this is why about 40% of analysts predict the growth of the pair to 1.1400, after which the pair is nevertheless expected to decline.

It should be noted that, in the medium term, the number of supporters of the EUR/USD decline exceeds 80%, just as it had been previously;

- As for the future of GBP/USD, here, quite naturally, a clear majority of indicators point southwards. However, almost 80% of experts believe that, in the near future, the pair will not fall below 1.2755 and will continue to move in the rising channel that has been prevailing since mid-March, in an attempt to break through the resistance at 1.3050. As for the medium-term forecast, almost 70% of analysts now stand on the side of the bears, saying that, in the end, the pair will return to the 1.2 400-1.2615 side channel;

- USD/JPY. When giving a forecast for the coming week, experts are divided into two precisely equal-sized groups: 50% predict the fall of the pair and 50% predict its growth. Graphical analysis, meanwhile, suggests the following scenario for H4: first, a fall of the pair into the 110.85-111.00 area, and then its subsequent growth to the resistance at 111.90; in the event this resistance is broken, the pair should reach 112.50. On D1, the expected movements of the pair differ somewhat: the drop is expected to be to 110.00, whilst the subsequent rebound is thought to be to the resistance at 112.25. As for the medium-term outlook, here the benchmarks remain unchanged: almost 80% of analysts cast their votes for the growth of the pair to 114.50;

- The last pair of our review is USD/CHF. Even now about half of the oscillators on H4 indicate this pair is overbought and recommend opening long positions. As for the rest of indicators, they have taken a neutral position, believing that the pair will stay in the sideways trend within the 0.9690-0.9775 range for a while. Almost 70% of experts agree with these latter readings, believing that the pair will definitely test the lower limit of this channel at least once more. Its subsequent fate, in the opinion of most analysts and graphical analysis on H4, is a return into the 0.9890-0.9965 zone.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#forex #forex_forecast #eurusd #signals_forex #binary_options

www.nordfx.com

First, a review of last week’s forecast:

- As we wrote last time, whilst experts and technical analysis make predictions, it is politicians that make reality. The President of the United States Donald Trump spent the past week in Europe, causing the scandals associated with him to temporarily quiet down. This led to a lull in the financial markets, which neither the OPEC meeting on Thursday 25 May or, notably, the G7 leadership meeting could shake. EUR/USD spent the whole week in the 1.1160-1.1267 side corridor, as if waiting for new events, and finished the five-day period practically in the same place where it started: at 1.1185;

- As for GBP/USD, recall that the bulk of experts (75%) voted for this pair’s fall. They ended up being right. This forecast was of a medium-term nature, so the fall of GBP/USD by 265 points (from 1.3040 to 1.2775) can be considered only a forerunner of the inception of this trend;

- As for USD/JPY, this pair, after the shocks of the second fortnight of May, decided to take a breather, just like EUR/USD. It moved in a side channel the entire week, rotating around the 111.30 Pivot Point: the precise point where it completed the week's session;

- It is common knowledge that USD/CHF often mirrors the fluctuations of EUR/USD. This exact phenomenon was observed this time: its lateral trend was restricted to the range of 0.9690-0.9775, and the pair finished in the same place it started five days prior, at 0.9744.

***

Many analysts seem to think that during all of 2017 the foreign exchange market will be shaped by the unpredictability surrounding Donald Trump’s Presidency of the United States, rather than by any of the usual economic forces.

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and broker companies, as well as forecasts made based on a variety of methods of technical and graphical analysis, we can say the following:

- If one were to draw a conclusion from conducting graphical analysis on H4, one would say that in the coming days EUR/USD expects a decline to the support at 1.1075; if it breaks though this support it would fall into the 1.1000 zone. The main resistance in this scenario would be in the 1.1270 zone. 60% of experts agree with this forecast, as do the overwhelming majority of trend indicators and oscillators on H4.

At the same time, it should be noted that on Friday the data on the US labor market (NFP) will be published: the forecasts of the NFP, a very important driving force for dollar movements, suggests a negative outlook for the US dollar. Perhaps this is why about 40% of analysts predict the growth of the pair to 1.1400, after which the pair is nevertheless expected to decline.

It should be noted that, in the medium term, the number of supporters of the EUR/USD decline exceeds 80%, just as it had been previously;

- As for the future of GBP/USD, here, quite naturally, a clear majority of indicators point southwards. However, almost 80% of experts believe that, in the near future, the pair will not fall below 1.2755 and will continue to move in the rising channel that has been prevailing since mid-March, in an attempt to break through the resistance at 1.3050. As for the medium-term forecast, almost 70% of analysts now stand on the side of the bears, saying that, in the end, the pair will return to the 1.2 400-1.2615 side channel;

- USD/JPY. When giving a forecast for the coming week, experts are divided into two precisely equal-sized groups: 50% predict the fall of the pair and 50% predict its growth. Graphical analysis, meanwhile, suggests the following scenario for H4: first, a fall of the pair into the 110.85-111.00 area, and then its subsequent growth to the resistance at 111.90; in the event this resistance is broken, the pair should reach 112.50. On D1, the expected movements of the pair differ somewhat: the drop is expected to be to 110.00, whilst the subsequent rebound is thought to be to the resistance at 112.25. As for the medium-term outlook, here the benchmarks remain unchanged: almost 80% of analysts cast their votes for the growth of the pair to 114.50;

- The last pair of our review is USD/CHF. Even now about half of the oscillators on H4 indicate this pair is overbought and recommend opening long positions. As for the rest of indicators, they have taken a neutral position, believing that the pair will stay in the sideways trend within the 0.9690-0.9775 range for a while. Almost 70% of experts agree with these latter readings, believing that the pair will definitely test the lower limit of this channel at least once more. Its subsequent fate, in the opinion of most analysts and graphical analysis on H4, is a return into the 0.9890-0.9965 zone.

Roman Butko, NordFX