NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

2 posters

Page 3 of 12

Page 3 of 12 •  1, 2, 3, 4 ... 10, 11, 12

1, 2, 3, 4 ... 10, 11, 12

GENERALIZED FOREX FORECAST FOR 8-12 DECEMBER 2014

GENERALIZED FOREX FORECAST FOR 8-12 DECEMBER 2014

Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on most different methods of technical and graphical analysis, the following can be predicted:

- 8-12 December, the EUR/USD pair will fall further by approximately 100 points to 1.2200. However, it’s quite possible that this may take up to two weeks. The resistance level is expected to be 1.2375;

- GBP/USD is expected to have a sideways trend with a slight fall to 1.5550 approximately;

- as for the USD/JPY pair, experts continue to wait for the rebound downwards, although now to the level of 120.80. At the same time, the indicators point strictly upwards to the 122.00 mark. So, most probably the pair will be fluctuating in the range of 120.80-122.00;

- the USD/CHF pair is unanimously predicted to rise to the level of April 2013, i.e. 0.9830-0.9850.

As for last week’s forecast:

- there was high probability that EUR/USD would fall to 1.2350, which, in fact, happened already on Wednesday. The pair spent the rest of the week in a sideways trend, still demonstrating a downward tendency;

- the forecast for GBP/USD was a sideways trend in the corridor of 1.5580-1.5675 with quite strong bearish pressure. The outlook was fully confirmed, and the pair spent the last day of the week between 1.5570 and 1.5690;

- throughout the start of the week, the USD/JPY pair was fulfilling the forecast aiming for the 119.15 mark. Further on, however, instead of the predicted rebound, a sharp breakthrough upwards occurred, and the pair ended Friday at 121.45;

- finally, the USD/CHF pair fully justified the expectations by reaching the promised level of 0.9800. The support level of 0.9620 was also predicted correctly – by rebounding from this bottom level, the pair shot upwards.

Roman Butko, NordFX

- 8-12 December, the EUR/USD pair will fall further by approximately 100 points to 1.2200. However, it’s quite possible that this may take up to two weeks. The resistance level is expected to be 1.2375;

- GBP/USD is expected to have a sideways trend with a slight fall to 1.5550 approximately;

- as for the USD/JPY pair, experts continue to wait for the rebound downwards, although now to the level of 120.80. At the same time, the indicators point strictly upwards to the 122.00 mark. So, most probably the pair will be fluctuating in the range of 120.80-122.00;

- the USD/CHF pair is unanimously predicted to rise to the level of April 2013, i.e. 0.9830-0.9850.

As for last week’s forecast:

- there was high probability that EUR/USD would fall to 1.2350, which, in fact, happened already on Wednesday. The pair spent the rest of the week in a sideways trend, still demonstrating a downward tendency;

- the forecast for GBP/USD was a sideways trend in the corridor of 1.5580-1.5675 with quite strong bearish pressure. The outlook was fully confirmed, and the pair spent the last day of the week between 1.5570 and 1.5690;

- throughout the start of the week, the USD/JPY pair was fulfilling the forecast aiming for the 119.15 mark. Further on, however, instead of the predicted rebound, a sharp breakthrough upwards occurred, and the pair ended Friday at 121.45;

- finally, the USD/CHF pair fully justified the expectations by reaching the promised level of 0.9800. The support level of 0.9620 was also predicted correctly – by rebounding from this bottom level, the pair shot upwards.

Roman Butko, NordFX

New account type at NordFX

New account type at NordFX

NordFX Expands Its Range of Account Types

NordFX is pleased to announce the introduction of a new account type – Account 1:1000.

Credit leverage up to 1:1000 allows you to get a larger trading capital, even with a small deposit, and thus increase your potential profits. In Accounts 1:1000 you’ll find flexible and advantageous trading conditions:

- Market execution

- Minimum deposit $5

- 20 currency pairs

- Fixed spreads from 3 pips

- Minimal lot 0.01

- Maximum lot 20, step 0.01

- Automated trading is allowed

NordFX always puts a priority on expanding the range of its services on the Forex market and providing its clients with new opportunities to secure profits. Open an Account 1:1000 with NordFX and maximize your gains!

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Please review the schedule of trading sessions for the Christmas and New Year holidays below.

From 00:00 24.12.2014 to Monday’s opening 05.01.2015, margin call and stop out levels will be increased up to 100% for “Micro,” “Account 1:1000,”“Standard,” “Welcome!” and “ZuluTrade” accounts. In the absence of stable market liquidity, NordFX reserves the right to increase the spreads for the financial instruments on the quotation lists of “Micro”, “Account 1:1000” and “Welcome!” accounts, or to stop quoting on specific currency pairs (for any type of account) until the market situation is back to normal.

We’d like to remind you that low liquidity and unpredictable market movements characterize the holiday period. Therefore, NordFX recommends providing sufficient margin for positions that may remain open during the holidays, to prevent automatic liquidation of positions at an undesirable price.

From 00:00 24.12.2014 to Monday’s opening 05.01.2015, margin call and stop out levels will be increased up to 100% for “Micro,” “Account 1:1000,”“Standard,” “Welcome!” and “ZuluTrade” accounts. In the absence of stable market liquidity, NordFX reserves the right to increase the spreads for the financial instruments on the quotation lists of “Micro”, “Account 1:1000” and “Welcome!” accounts, or to stop quoting on specific currency pairs (for any type of account) until the market situation is back to normal.

We’d like to remind you that low liquidity and unpredictable market movements characterize the holiday period. Therefore, NordFX recommends providing sufficient margin for positions that may remain open during the holidays, to prevent automatic liquidation of positions at an undesirable price.

GENERALIZED FOREX FORECAST FOR 22-26 DECEMBER 2014

GENERALIZED FOREX FORECAST FOR 22-26 DECEMBER 2014

Generalizing in a table the opinions of 35 analysts from world top banks and broker companies and forecasts based on various methods of technical and graphical analysis, it can be concluded that… Christmas is round the corner, and so the main currency pairs are likely to stay in a lulling sideways trend before the holidays (unless, of course, something extraordinary happens):

- the EUR/USD pair will oscillate around 1.2270-1.2280, most likely gravitating downwards in an effort to break through the level of 1.2200;

- the same can be said about the GBP/USD pair, whose target will be 1.5530;

- USD/JPY will most probably try to reach the height of 120.00 after all, although in the first half of the week it may fall to 118.50 and even to 117.50;

- finally, USD/CHF will, with high probability, remain in a sideways trend, moving along the level of 0.9800.

As for last week’s forecast, it appears to have come true practically 100%:

- the EUR/USD pair completely followed the predicted trends – first it rose, breaking through the level of 1.2500, and then crashed downwards – first to 1.2375 and then even further down, finishing the week at 1.2225;

- the forecast for GBP/USD also turned out to be correct – the pair continued its sideways movement in the range, the boundaries of which had already been set in November;

- similarly, the behavior of the USD/JPY pair was fully predictable – completing the rebound, it shot upwards, although it didn’t quite reach the set target of 120.65 and finished the week at 119.53;

- finally, the USD/CHF pair’s movements were also quite foreseeable – pushing off from the support level of 0.9575, it made a powerful surge upwards, breaking through the level of 0.9800.

Roman Butko, NordFX

- the EUR/USD pair will oscillate around 1.2270-1.2280, most likely gravitating downwards in an effort to break through the level of 1.2200;

- the same can be said about the GBP/USD pair, whose target will be 1.5530;

- USD/JPY will most probably try to reach the height of 120.00 after all, although in the first half of the week it may fall to 118.50 and even to 117.50;

- finally, USD/CHF will, with high probability, remain in a sideways trend, moving along the level of 0.9800.

As for last week’s forecast, it appears to have come true practically 100%:

- the EUR/USD pair completely followed the predicted trends – first it rose, breaking through the level of 1.2500, and then crashed downwards – first to 1.2375 and then even further down, finishing the week at 1.2225;

- the forecast for GBP/USD also turned out to be correct – the pair continued its sideways movement in the range, the boundaries of which had already been set in November;

- similarly, the behavior of the USD/JPY pair was fully predictable – completing the rebound, it shot upwards, although it didn’t quite reach the set target of 120.65 and finished the week at 119.53;

- finally, the USD/CHF pair’s movements were also quite foreseeable – pushing off from the support level of 0.9575, it made a powerful surge upwards, breaking through the level of 0.9800.

Roman Butko, NordFX

GENERALIZED FOREX FORECAST FOR 5-9 JANUARY 2015

GENERALIZED FOREX FORECAST FOR 5-9 JANUARY 2015

Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, the following can be said:

- despite most indicators showing a further fall of the EUR/USD and GBP/USD pairs, analysts are inclined towards a more probable sideways trend with a rebound upwards at the beginning of the week. Certain key indicators also point towards overselling and strong volatility;

- there’s rare unanimity regarding the USD/JPY pair – upwards and only upwards to the height of 121.00 and even further up;

- the USD/CHF pair is very likely to try and secure its position above the key mark of 1.0000, while strong fluctuations are not expected.

It is said that New Year is a time of surprises. It turns out that it’s not only Santa Claus who brings them but also… Forex. As for last week’s forecast:

- at the start of the week, EUR/USD tried to follow our forecast and, having risen slightly, it began a smooth descent. Then at midnight from 1st to 2nd January, the pair shot off like a high-board diver, demonstrating a spectacular price gap of 50 points, and then continued its rapid decline slowing down only at 1.2000;

- even more impressive was the fall of the British Pound – the GBP/USD pair tumbled downwards by 300 points altogether;

- in spite of a gap, USD/JPY confirmed our forecast almost 100% – first it fell to the level of 118.850 and then went upwards, reaching the height of 120.00 as expected;

- as for USD/CHF, it was sure to reach the symbolic mark of 1.0000 at some point but very few thought it would happen so soon. Indeed, New Year is a time of surprises!

Roman Butko, NordFX

- despite most indicators showing a further fall of the EUR/USD and GBP/USD pairs, analysts are inclined towards a more probable sideways trend with a rebound upwards at the beginning of the week. Certain key indicators also point towards overselling and strong volatility;

- there’s rare unanimity regarding the USD/JPY pair – upwards and only upwards to the height of 121.00 and even further up;

- the USD/CHF pair is very likely to try and secure its position above the key mark of 1.0000, while strong fluctuations are not expected.

It is said that New Year is a time of surprises. It turns out that it’s not only Santa Claus who brings them but also… Forex. As for last week’s forecast:

- at the start of the week, EUR/USD tried to follow our forecast and, having risen slightly, it began a smooth descent. Then at midnight from 1st to 2nd January, the pair shot off like a high-board diver, demonstrating a spectacular price gap of 50 points, and then continued its rapid decline slowing down only at 1.2000;

- even more impressive was the fall of the British Pound – the GBP/USD pair tumbled downwards by 300 points altogether;

- in spite of a gap, USD/JPY confirmed our forecast almost 100% – first it fell to the level of 118.850 and then went upwards, reaching the height of 120.00 as expected;

- as for USD/CHF, it was sure to reach the symbolic mark of 1.0000 at some point but very few thought it would happen so soon. Indeed, New Year is a time of surprises!

Roman Butko, NordFX

GENERALIZED FOREX FORECAST FOR 12-16 JANUARY 2015

GENERALIZED FOREX FORECAST FOR 12-16 JANUARY 2015

Generalizing the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on most different methods of technical and graphical analysis, it becomes clear that there is no sufficient certainty about any of the pairs:

- for instance, almost a third of the analysts forecast growth for EUR/USD. The indicators show 50/50 chances for the upcoming days, though all of them predict a further fall for the pair later on. Thus, it is quite possible that at the start of the week EUR/USD will still rise to 1.9000, after which it will continue its main trend downwards – to 1.1750 and then further to 1.1650;

- the British Pound may copy the euro – first a rise followed by a drop. At the same time, some analysts believe that GBP/USD, being under bearish pressure, will still remain in the sideways trend;

- everyone expects USD/JPY to return to the range of 120.00-121.00 while the medium-term target is indicated as 121.75;

- the forecast for the USD/CHF pair remains the same as for the previous week – sideways movement along the level of 1.0000.

As for last week’s forecast, New Year’s surprises didn’t finish with the overnight gap of 1-2 January. The scenario was replayed 5 days later, pleasing the bears with another gap, and EUR/USD and GBP/USD continued their rapid fall. As a result, the euro went down to the low of summer 2010, and now the next target is 10-year June mark.

The dollar got stronger against the yen as well. The USD/JPY pair could not reach 121.00 and rolled back down to the level of the middle of December 2014.

Finally, as predicted, USD/CHF got fixed above the key mark of 1.0000 and finished Friday at 1.0140.

Roman Butko, NordFX

- for instance, almost a third of the analysts forecast growth for EUR/USD. The indicators show 50/50 chances for the upcoming days, though all of them predict a further fall for the pair later on. Thus, it is quite possible that at the start of the week EUR/USD will still rise to 1.9000, after which it will continue its main trend downwards – to 1.1750 and then further to 1.1650;

- the British Pound may copy the euro – first a rise followed by a drop. At the same time, some analysts believe that GBP/USD, being under bearish pressure, will still remain in the sideways trend;

- everyone expects USD/JPY to return to the range of 120.00-121.00 while the medium-term target is indicated as 121.75;

- the forecast for the USD/CHF pair remains the same as for the previous week – sideways movement along the level of 1.0000.

As for last week’s forecast, New Year’s surprises didn’t finish with the overnight gap of 1-2 January. The scenario was replayed 5 days later, pleasing the bears with another gap, and EUR/USD and GBP/USD continued their rapid fall. As a result, the euro went down to the low of summer 2010, and now the next target is 10-year June mark.

The dollar got stronger against the yen as well. The USD/JPY pair could not reach 121.00 and rolled back down to the level of the middle of December 2014.

Finally, as predicted, USD/CHF got fixed above the key mark of 1.0000 and finished Friday at 1.0140.

Roman Butko, NordFX

Binary options at NordFX

Binary options at NordFX

It’s time for new and exciting trading opportunities! NordFX is pleased to announce the launch of its Binary Options platform (binary.nordfx.com).

Binary options are both a very simple and high-yielding tool. All you need to do is invest, select an asset and make a prediction whether the price for the asset will go up or down by a certain time (expiry).

Trading binary options with NordFX, you get:

• Minimal deposit $1 / 1€

• Easy-to-understand trading principles

• Potential profits known as you open a position

• 6 types of options: Binary Options, One Touch, 60 Seconds, Pairs, Long Term, Ladder

• A wide range of trading assets: currencies, stocks, commodities and indices

• Newsfeed to be updated on all key market events and make educated decisions

High returns, ease of use, controlled risks set binary options apart and make them an excellent and quite safe way to enter the financial market for the first time.

NordFX stays true to its priority to offer you the best and the latest on the market, and we trust that with our binary options platform your trading will become ever more engaging, diverse and profitable.

Sign up and enjoy quick and easy returns!

Binary options are both a very simple and high-yielding tool. All you need to do is invest, select an asset and make a prediction whether the price for the asset will go up or down by a certain time (expiry).

Trading binary options with NordFX, you get:

• Minimal deposit $1 / 1€

• Easy-to-understand trading principles

• Potential profits known as you open a position

• 6 types of options: Binary Options, One Touch, 60 Seconds, Pairs, Long Term, Ladder

• A wide range of trading assets: currencies, stocks, commodities and indices

• Newsfeed to be updated on all key market events and make educated decisions

High returns, ease of use, controlled risks set binary options apart and make them an excellent and quite safe way to enter the financial market for the first time.

NordFX stays true to its priority to offer you the best and the latest on the market, and we trust that with our binary options platform your trading will become ever more engaging, diverse and profitable.

Sign up and enjoy quick and easy returns!

GENERALIZED FOREX FORECAST FOR 19-23 JANUARY 2015

GENERALIZED FOREX FORECAST FOR 19-23 JANUARY 2015

After summing up the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, it’s become clear that many experts are at a loss, and the graphical analysis provides contradictory readings. However:

- EUR/USD is an exception. The overwhelming assessment of its future is that the pair will continue to fall to the level of 1.1400 and in case of breaking it even further to 1.1200. After that, EUR/USD may actually bounce up to 1.1785-1.800;

- despite bearish pressure, GBP/USD will stay in the sideways trend. The most probable fluctuation range is 1.5020-1.5250;

- USD/JPY is also in the sideways trend under bearish pressure. It’s predicted to go down to 115.20-116.00, with a possible rise just to 118.75. The graphical analysis shows that by the end of this week or next week the pair may return to an upward trend moving to the previous target of 121.75;

- it is difficult to make any forecast for USD/CHF at this time – the market is at a loss, although for the most part the pair is expected to go down.

As for last week’s forecast, the New Year's surprises were not limited to the two gaps of early January. Last Thursday the Bank of Switzerland played Santa Claus (albeit belatedly) and as a ‘gift’ suddenly removed the bottom trade boundary for USD/CHF. Even analysts from the largest banks did not expect this at all. As a result, all the predictions for USD/CHF made before 15 January become invalid.

This milestone event could not but affect other currencies. For example, the forecast for EUR/USD was that it would fall to 1.1650 by the end of the week. In fact, another 200 points have to be added to this, thanks to the Bank of Switzerland. As a result, on Friday the pair crashed below the level of 1.1460.

The GBP/USD pair, however, demonstrated impressive resistance to stress. We predicted a sideways trend for it, which was confirmed 100%. The pair finished trading at the same level as at the beginning of the week.

Roman Butko, NordFX

- EUR/USD is an exception. The overwhelming assessment of its future is that the pair will continue to fall to the level of 1.1400 and in case of breaking it even further to 1.1200. After that, EUR/USD may actually bounce up to 1.1785-1.800;

- despite bearish pressure, GBP/USD will stay in the sideways trend. The most probable fluctuation range is 1.5020-1.5250;

- USD/JPY is also in the sideways trend under bearish pressure. It’s predicted to go down to 115.20-116.00, with a possible rise just to 118.75. The graphical analysis shows that by the end of this week or next week the pair may return to an upward trend moving to the previous target of 121.75;

- it is difficult to make any forecast for USD/CHF at this time – the market is at a loss, although for the most part the pair is expected to go down.

As for last week’s forecast, the New Year's surprises were not limited to the two gaps of early January. Last Thursday the Bank of Switzerland played Santa Claus (albeit belatedly) and as a ‘gift’ suddenly removed the bottom trade boundary for USD/CHF. Even analysts from the largest banks did not expect this at all. As a result, all the predictions for USD/CHF made before 15 January become invalid.

This milestone event could not but affect other currencies. For example, the forecast for EUR/USD was that it would fall to 1.1650 by the end of the week. In fact, another 200 points have to be added to this, thanks to the Bank of Switzerland. As a result, on Friday the pair crashed below the level of 1.1460.

The GBP/USD pair, however, demonstrated impressive resistance to stress. We predicted a sideways trend for it, which was confirmed 100%. The pair finished trading at the same level as at the beginning of the week.

Roman Butko, NordFX

Generalized Forex Forecast for 26-30 January 2015

Generalized Forex Forecast for 26-30 January 2015

Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, the following can be expected:

- before returning to its main trend and continuing towards 1.1100, EUR/USD may go up to the level of 1.1380-1.1460;

- GBP/USD, also under bearish pressure overall, may at first rise to 1.5065 and then continue its fall to 1.4900;

- USD/JPY is expected to mirror the movements of its counterparts – after a fall it will rebound from 113.50 and rush up to its nearest target of 119.00;

- after surviving the recent shock, USD/CHF can be expected to continue its sideways trend with a rise to 0.8910-0.9000 and then a decrease to 0.8350.

As for the last week’s forecast:

- ECB President Mario Draghi met our expectations and helped our forecast for EUR/USD to fulfil to the tee. After his speech, the Euro swiftly broke through 1.1400 and, as was predicted, finished the week near 1.1200;

- following the Euro, GBP/USD succumbed to Mr. Draghi’s charms which resulted in the level of 1.5020, predicted to be the lower boundary, reversing direction and becoming the upper boundary of the corridor;

- the forecast for USD/JPY was confirmed 100% – the pair was in a sideways trend, then reached the predicted mark of 118.75 and returned to 117.70, the level of the beginning of the week;

- it turns out that no prediction can also be a prediction, which was backed up by the USD/CHF pair. Along with the analysts, we refused to make any suggestions regarding its fluctuations last week. Apparently, in sync with our doubts, the pair decided not to leave the rigid boundaries of its sideways trend throughout the whole week.

Roman Butko, NordFX

- before returning to its main trend and continuing towards 1.1100, EUR/USD may go up to the level of 1.1380-1.1460;

- GBP/USD, also under bearish pressure overall, may at first rise to 1.5065 and then continue its fall to 1.4900;

- USD/JPY is expected to mirror the movements of its counterparts – after a fall it will rebound from 113.50 and rush up to its nearest target of 119.00;

- after surviving the recent shock, USD/CHF can be expected to continue its sideways trend with a rise to 0.8910-0.9000 and then a decrease to 0.8350.

As for the last week’s forecast:

- ECB President Mario Draghi met our expectations and helped our forecast for EUR/USD to fulfil to the tee. After his speech, the Euro swiftly broke through 1.1400 and, as was predicted, finished the week near 1.1200;

- following the Euro, GBP/USD succumbed to Mr. Draghi’s charms which resulted in the level of 1.5020, predicted to be the lower boundary, reversing direction and becoming the upper boundary of the corridor;

- the forecast for USD/JPY was confirmed 100% – the pair was in a sideways trend, then reached the predicted mark of 118.75 and returned to 117.70, the level of the beginning of the week;

- it turns out that no prediction can also be a prediction, which was backed up by the USD/CHF pair. Along with the analysts, we refused to make any suggestions regarding its fluctuations last week. Apparently, in sync with our doubts, the pair decided not to leave the rigid boundaries of its sideways trend throughout the whole week.

Roman Butko, NordFX

Generalized Forex Forecast for 2-6 February 2015

Generalized Forex Forecast for 2-6 February 2015

Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, the following can be expected:

- EUR/USD will continue its downward tendency to the 1.1100 mark, although the opinions of analysts were divided almost equally: a third predict growth for the pair, a third – its fall and a third – a sideways trend;

- the situation with GBP/USD is similar while bearish tendencies look more convincing in this case;

- there is no consensus about the USD/JPY pair this week either among analysts or among indicators, something that happens very rarely. Here the choice is between a sideways movement and the pair’s long-time tendency towards the range of 119.00-121.00, which it is very likely to reach after all;

- both analysts and indicators predict USD/CHF to return to the level of last autumn, with strong volatility too, intraday fluctuations reaching 150 and even 200 points.

As for the last week’s forecast:

- we predicted EUR/USD to fall to 1.1100 and possibly go up to 1.1380-1.1460. It did happen, just in the reverse order – first the pair slipped down to the 1.1094 mark, rebounded to 1.1420, then calmed down and entered a sideways trend with the upper boundary of 1.1380;

- as predicted for the start of the week, GBP/USD rebounded upwards and way more than expected. As a result, another attempt by the pair to fall to the low of 1.4900 failed and the pair was thrown off to the level of the beginning of the week – 1.4986;

- as anticipated, the USD/JPY pair tried to reach its nearest target of 119.00 but weakened at the level of 118.66, took a break and entered a sideways trend;

- USD/CHF was set on partially winning back its Black Thursday losses – it rushed upwards and quickly achieved the predicted level of 0.9000, stayed there for three days and then dashed even higher, soaring up by almost 300 points and reaching the 0.9285 mark by Friday.

Roman Butko, NordFX

- EUR/USD will continue its downward tendency to the 1.1100 mark, although the opinions of analysts were divided almost equally: a third predict growth for the pair, a third – its fall and a third – a sideways trend;

- the situation with GBP/USD is similar while bearish tendencies look more convincing in this case;

- there is no consensus about the USD/JPY pair this week either among analysts or among indicators, something that happens very rarely. Here the choice is between a sideways movement and the pair’s long-time tendency towards the range of 119.00-121.00, which it is very likely to reach after all;

- both analysts and indicators predict USD/CHF to return to the level of last autumn, with strong volatility too, intraday fluctuations reaching 150 and even 200 points.

As for the last week’s forecast:

- we predicted EUR/USD to fall to 1.1100 and possibly go up to 1.1380-1.1460. It did happen, just in the reverse order – first the pair slipped down to the 1.1094 mark, rebounded to 1.1420, then calmed down and entered a sideways trend with the upper boundary of 1.1380;

- as predicted for the start of the week, GBP/USD rebounded upwards and way more than expected. As a result, another attempt by the pair to fall to the low of 1.4900 failed and the pair was thrown off to the level of the beginning of the week – 1.4986;

- as anticipated, the USD/JPY pair tried to reach its nearest target of 119.00 but weakened at the level of 118.66, took a break and entered a sideways trend;

- USD/CHF was set on partially winning back its Black Thursday losses – it rushed upwards and quickly achieved the predicted level of 0.9000, stayed there for three days and then dashed even higher, soaring up by almost 300 points and reaching the 0.9285 mark by Friday.

Roman Butko, NordFX

Generalized Forex Forecast for 9-13 February 2015

Generalized Forex Forecast for 9-13 February 2015

Generalizing the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, the following can be predicted:

- the EUR/USD pair can expect fluctuations around the level of 1.1325 this week while at the beginning of the week it may fall to 1.1185-1.1200, then rise and move to 1.1550;

- a similar scenario is possible for GBP/USD. The pair will be aiming to secure itself around 1.5200 but at the start of the week a short-term fall to 1.5015 is not excluded, with a subsequent rise and transition to the range of 1.5200-1.5400;

- USD/JPY is very likely to reach 119.00 and advance towards the next target of 120.00, to be followed by a pullback to the support level of 117.00;

- the USD/CHF pair is predicted to continue its sideways trend, with prevailing bullish tendencies and a desire to win back its Black Thursday losses. The closest target is 0.9400.

Regarding last week’s forecast:

- EUR/USD almost fully met our expectations. To recap, the opinions of the analysts were evenly split 3 ways: a third was for a rise, a third – for a fall and a third – for a sideways trend. The EUR/USD chart actually shows that all week long the pair was either up or down, finishing at the level where it had started;

- at the start of the week, GBP/USD began to succumb to the predicted bearish pressure but then the strengthened bulls launched the pair way up, which resulted in GBP/USD breaking through the key level of this year – 1.5200;

- the forecast for USD/JPY was confirmed 100% – first, the pair was in a sideways trend and then surged upwards on Friday. As a result, on the news from the USA, the pair reached the coveted mark of 119.00;

- there were no surprises with the USD/CHF pair either. As predicted, it got to the level of last September and then took a break by going into a sideways trend.

Roman Butko, NordFX

- the EUR/USD pair can expect fluctuations around the level of 1.1325 this week while at the beginning of the week it may fall to 1.1185-1.1200, then rise and move to 1.1550;

- a similar scenario is possible for GBP/USD. The pair will be aiming to secure itself around 1.5200 but at the start of the week a short-term fall to 1.5015 is not excluded, with a subsequent rise and transition to the range of 1.5200-1.5400;

- USD/JPY is very likely to reach 119.00 and advance towards the next target of 120.00, to be followed by a pullback to the support level of 117.00;

- the USD/CHF pair is predicted to continue its sideways trend, with prevailing bullish tendencies and a desire to win back its Black Thursday losses. The closest target is 0.9400.

Regarding last week’s forecast:

- EUR/USD almost fully met our expectations. To recap, the opinions of the analysts were evenly split 3 ways: a third was for a rise, a third – for a fall and a third – for a sideways trend. The EUR/USD chart actually shows that all week long the pair was either up or down, finishing at the level where it had started;

- at the start of the week, GBP/USD began to succumb to the predicted bearish pressure but then the strengthened bulls launched the pair way up, which resulted in GBP/USD breaking through the key level of this year – 1.5200;

- the forecast for USD/JPY was confirmed 100% – first, the pair was in a sideways trend and then surged upwards on Friday. As a result, on the news from the USA, the pair reached the coveted mark of 119.00;

- there were no surprises with the USD/CHF pair either. As predicted, it got to the level of last September and then took a break by going into a sideways trend.

Roman Butko, NordFX

Generalized Forex Forecast for 16-20 February 2015

Generalized Forex Forecast for 16-20 February 2015

Generalizing the opinions of 35 analysts from world leading banks and broker companies plus forecasts based on different methods of technical and graphical analysis, I’d like to point out that green and black colours prevail in the table this week. This means that all the pairs are expected to be in a sideways trend with an aspiration to move upwards:

- EUR/USD is very likely to carry on with its drive to reach the 1.1550 mark. Nevertheless, there’s a chance that in the first couple of days the pair will go down to 1.1340, bounce off it and then move upwards;

- the GBP/USD pair can be expected to fall to the level of 1.5300-1.5340 and then rebound to 1.5550;

- the USD/JPY pair’s strong support is 118.40. After bouncing off it, the pair may charge up to around 121.00. However, this may not happen immediately but only in the last ten days of February;

- the forecast for USD/CHF remains as before – a further sideways trend with prevailing bullish tendencies, the nearest target being 0.9400. Bear mind though that in the medium term the pair may break through support at the level of 0.9200 and sharply go down to around 0.9000 where it was at the end of January.

Last week’s forecast was confirmed almost 100%:

- it was predicted that EUR/USD would be in a sideways trend with fluctuations around 1.1325, followed by a rise and a move towards 1.1550. The pair did just that – it finished the sideways trend on Friday and shot upwards. However, the level that the pair reached turned out to be a bit more modest – 1.1443;

- a similar scenario was suggested for the GBP/USD pair. The forecast was fully confirmed, and by the end of the week, the pair reached the target at the level of 1.5400;

- the USD/JPY pair also fully complied with our predictions. It got to 120.00 by the middle of the week and rolled down by 200 points;

- no surprises with the USD/CHF pair either – as predicted, it was in a sideways trend all week long, with prevailing bullish tendencies under whose influence the pair regained 100 points.

Roman Butko, NordFX

- EUR/USD is very likely to carry on with its drive to reach the 1.1550 mark. Nevertheless, there’s a chance that in the first couple of days the pair will go down to 1.1340, bounce off it and then move upwards;

- the GBP/USD pair can be expected to fall to the level of 1.5300-1.5340 and then rebound to 1.5550;

- the USD/JPY pair’s strong support is 118.40. After bouncing off it, the pair may charge up to around 121.00. However, this may not happen immediately but only in the last ten days of February;

- the forecast for USD/CHF remains as before – a further sideways trend with prevailing bullish tendencies, the nearest target being 0.9400. Bear mind though that in the medium term the pair may break through support at the level of 0.9200 and sharply go down to around 0.9000 where it was at the end of January.

Last week’s forecast was confirmed almost 100%:

- it was predicted that EUR/USD would be in a sideways trend with fluctuations around 1.1325, followed by a rise and a move towards 1.1550. The pair did just that – it finished the sideways trend on Friday and shot upwards. However, the level that the pair reached turned out to be a bit more modest – 1.1443;

- a similar scenario was suggested for the GBP/USD pair. The forecast was fully confirmed, and by the end of the week, the pair reached the target at the level of 1.5400;

- the USD/JPY pair also fully complied with our predictions. It got to 120.00 by the middle of the week and rolled down by 200 points;

- no surprises with the USD/CHF pair either – as predicted, it was in a sideways trend all week long, with prevailing bullish tendencies under whose influence the pair regained 100 points.

Roman Butko, NordFX

Generalized Forex Forecast for 2-6 March 2015

Generalized Forex Forecast for 2-6 March 2015

Generalizing the opinions of 35 analysts from world leading banks and broker companies and forecasts based on various methods of technical and graphical analysis, it can be noted that this week, just like last week, the sideways trend will be dominating for all four pairs:

- the corridor of 1.1170-1.1310 is most probable for the EUR/USD pair, although technical analysis indications are still contradictory. A number indicators point to bearish trends while some others show the opposite – the pair’s upward drive to 1.1450-1.1500;

- the GBP/USD pair is predicted to fall to the level of 1.5000 and then further to 1.4810 during March. Short-term, the pair may rise and make another attempt to break through the strong level of support around 1.5550;

- this week the target for USD/JPY remains the same – 120.50. Strong support is around 118.50, the second support being 117.50;

- the plan for USD/CHF is as follows: getting up to 0.9735 step by step, then a sharp rebound downwards to around 0.9375 and further to 0.9280. However, the realisation of this scenario may stretch out over several weeks.

As for last week’s forecast:

- as predicted, in the first half of the week, EUR/USD stayed in a sideways trend. Then on Thursday, on the news from the USA, it fell sharply and so didn’t meet the expectations of many analysts (including ours);

- GBP/USD was also expected to move sideways in the range of 1.5340-1.5500. By mid-week, the pair tried to break through the top boundary, reached 1.5550 but the very same news from the USA quickly returned it to the centre of the corridor specified by us;

- according to our “plan,” USD/JPY was supposed stay in a sideways trend all week long, demonstrating a consistent drive to reach 120.50, which happened, except that the target turned out to be even more modest – 119.80;

- finally the USD/CHF pair. The forecast of its attempts to reach the 0.9555 mark was confirmed 100%.

Roman Butko, NordFX

- the corridor of 1.1170-1.1310 is most probable for the EUR/USD pair, although technical analysis indications are still contradictory. A number indicators point to bearish trends while some others show the opposite – the pair’s upward drive to 1.1450-1.1500;

- the GBP/USD pair is predicted to fall to the level of 1.5000 and then further to 1.4810 during March. Short-term, the pair may rise and make another attempt to break through the strong level of support around 1.5550;

- this week the target for USD/JPY remains the same – 120.50. Strong support is around 118.50, the second support being 117.50;

- the plan for USD/CHF is as follows: getting up to 0.9735 step by step, then a sharp rebound downwards to around 0.9375 and further to 0.9280. However, the realisation of this scenario may stretch out over several weeks.

As for last week’s forecast:

- as predicted, in the first half of the week, EUR/USD stayed in a sideways trend. Then on Thursday, on the news from the USA, it fell sharply and so didn’t meet the expectations of many analysts (including ours);

- GBP/USD was also expected to move sideways in the range of 1.5340-1.5500. By mid-week, the pair tried to break through the top boundary, reached 1.5550 but the very same news from the USA quickly returned it to the centre of the corridor specified by us;

- according to our “plan,” USD/JPY was supposed stay in a sideways trend all week long, demonstrating a consistent drive to reach 120.50, which happened, except that the target turned out to be even more modest – 119.80;

- finally the USD/CHF pair. The forecast of its attempts to reach the 0.9555 mark was confirmed 100%.

Roman Butko, NordFX

Generalized Forex Forecast for 9-13 March 2015

Generalized Forex Forecast for 9-13 March 2015

Looking at what has been happening on the currency markets for the past few weeks, we get the impression that soon our screens will show EUR/USD/CHF = 1.0000.

In the meantime, generalizing the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, we can note that... analysts are simply perplexed: 25% support growth, 25% support a fall and 50% are just at a loss. Therefore, in our forecast for the coming week, we will primarily focus on the indicators and secondly on our own logic and intuition:

- for the EUR/USD pair, the corridor 1.0760-1.1225 is most probable, with prevailing bearish trends and the pair’s downward tendency to the level of 1.0700;

- GBP/USD may rebound to around 1.5225 at the start of the week, followed by a fall all the way down to 1.4910;

- the USD/JPY pair is likely to rise to the last week’s high of 121.27 and further to the range of 121.80-122.50. Its support will be at 119.50-119.80;

- the previous plan for USD/CHF stands – moving step by step up towards the symbolic level of 1.0000. The only thing that we can predict is that the movement will be smoother than last week.

As for last week’s forecast, it turned out to be quite modest:

- as predicted, the EUR/USD pair spent the first half of the week in a sideways trend but then, thanks to the ECB’s actions and reports from the USA, the pair easily broke through the lower boundary of the range and went down sharply, proving that indicators could be much more accurate than the deliberations of high-browed analysts. (Remember that 83% of indicators pointed towards the fall of the pair while only 32% of analysts were of this opinion.);

- we predicted that GBP/USD would fall to 1.5000 and then further to 1.4810 during March. But over the past week, the pair completed a massive part of the set task at a record-breaking pace and was short of 1.5000 by a mere 30 points;

- last week, USD/JPY was predicted to go up to the level of 120.50. It did happen as a matter of fact – the pair completed the weekly session at 120.81. Yet, just a few hours before that the pair had reached 121.27 and only after that it returned to the specified level;

- the USD/CHF pair also easily beat the target. It was predicted to advance smoothly up to 0.9735 but actually it briskly rose at an angel of almost 45 degrees and made it to 0.9854, exceeding the set target by 120 points.

Roman Butko, NordFX

In the meantime, generalizing the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, we can note that... analysts are simply perplexed: 25% support growth, 25% support a fall and 50% are just at a loss. Therefore, in our forecast for the coming week, we will primarily focus on the indicators and secondly on our own logic and intuition:

- for the EUR/USD pair, the corridor 1.0760-1.1225 is most probable, with prevailing bearish trends and the pair’s downward tendency to the level of 1.0700;

- GBP/USD may rebound to around 1.5225 at the start of the week, followed by a fall all the way down to 1.4910;

- the USD/JPY pair is likely to rise to the last week’s high of 121.27 and further to the range of 121.80-122.50. Its support will be at 119.50-119.80;

- the previous plan for USD/CHF stands – moving step by step up towards the symbolic level of 1.0000. The only thing that we can predict is that the movement will be smoother than last week.

As for last week’s forecast, it turned out to be quite modest:

- as predicted, the EUR/USD pair spent the first half of the week in a sideways trend but then, thanks to the ECB’s actions and reports from the USA, the pair easily broke through the lower boundary of the range and went down sharply, proving that indicators could be much more accurate than the deliberations of high-browed analysts. (Remember that 83% of indicators pointed towards the fall of the pair while only 32% of analysts were of this opinion.);

- we predicted that GBP/USD would fall to 1.5000 and then further to 1.4810 during March. But over the past week, the pair completed a massive part of the set task at a record-breaking pace and was short of 1.5000 by a mere 30 points;

- last week, USD/JPY was predicted to go up to the level of 120.50. It did happen as a matter of fact – the pair completed the weekly session at 120.81. Yet, just a few hours before that the pair had reached 121.27 and only after that it returned to the specified level;

- the USD/CHF pair also easily beat the target. It was predicted to advance smoothly up to 0.9735 but actually it briskly rose at an angel of almost 45 degrees and made it to 0.9854, exceeding the set target by 120 points.

Roman Butko, NordFX

Generalized Forex Forecast for 16-20 March 2015

Generalized Forex Forecast for 16-20 March 2015

Upon generalizing the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, it appears that analysts are still at a complete loss, not quite sure what to expect from the market. Unlike the analysts, indicators and our own intuition send pretty clear signals regarding the upcoming week:

- EUR/USD is a very short distance away from the coveted mark of 1.0000, which the pair will try to reach in the nearest future. With this, considering the medium term perspective, analysts come out of their stupor and almost unanimously predict a rebound upwards to 1.1000-1.1200 over the next few weeks;

- as for the GBP/USD pair, the proud Brit can be expected to unwillingly follow the sinking “Titanic”, i.e. the Euro;

- the USD/JPY pair will try to break out of its sideways trend and rise from the range of 120.90-121.65 to the level of 121.50-122.50. The pair may actually reach its next target 123.00 rather quickly. The main support will be around 120.65-120.80;

- the plan for USD/CHF remains the same – upwards to 1.0250, in hopes to fully compensate for the losses of January’s “Black Thursday”.

As for last week’s forecast, my gut feeling was right. Seven days ago, EUR/USD and USD/CHF were predicted to level off around 1.0000. Here are the outcomes:

- EUR/USD fell by 400 points and made it halfway to the target. Just as much remains till the ultimate target;

- the USD/CHF pair actually exceeded expectations and reached 1.01250 on Thursday;

- sticking to the forecast overall, GBP/USD also exceeded the week’s plan. As predicted, it shot up by 100 points on Monday, then rolled downwards and by Thursday reached 1.4910, the mark forecast earlier. Further, the pair rebounded by another 100 points and fell to the level of 1.4750;

- USD/JPY was expected to rise to around 121.80-122.50, which is what happened – the pair got to the landmark of 122.00 and then entered a sideways trend in the corridor of 120.90-121.65.

Roman Butko, NordFX

- EUR/USD is a very short distance away from the coveted mark of 1.0000, which the pair will try to reach in the nearest future. With this, considering the medium term perspective, analysts come out of their stupor and almost unanimously predict a rebound upwards to 1.1000-1.1200 over the next few weeks;

- as for the GBP/USD pair, the proud Brit can be expected to unwillingly follow the sinking “Titanic”, i.e. the Euro;

- the USD/JPY pair will try to break out of its sideways trend and rise from the range of 120.90-121.65 to the level of 121.50-122.50. The pair may actually reach its next target 123.00 rather quickly. The main support will be around 120.65-120.80;

- the plan for USD/CHF remains the same – upwards to 1.0250, in hopes to fully compensate for the losses of January’s “Black Thursday”.

As for last week’s forecast, my gut feeling was right. Seven days ago, EUR/USD and USD/CHF were predicted to level off around 1.0000. Here are the outcomes:

- EUR/USD fell by 400 points and made it halfway to the target. Just as much remains till the ultimate target;

- the USD/CHF pair actually exceeded expectations and reached 1.01250 on Thursday;

- sticking to the forecast overall, GBP/USD also exceeded the week’s plan. As predicted, it shot up by 100 points on Monday, then rolled downwards and by Thursday reached 1.4910, the mark forecast earlier. Further, the pair rebounded by another 100 points and fell to the level of 1.4750;

- USD/JPY was expected to rise to around 121.80-122.50, which is what happened – the pair got to the landmark of 122.00 and then entered a sideways trend in the corridor of 120.90-121.65.

Roman Butko, NordFX

Generalized Forex Forecast for 23-27 March 2015

Generalized Forex Forecast for 23-27 March 2015

Summing up in a table the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, we had to introduce some changes. If you look at the analysts’ opinions row in the table, along with the symbols of upward, sideways and downward trends, you will find a new one – open hands. As you can imagine, this indicates those analysts who are at a total loss and don’t know what to say. This group is quite large (around 30%) but there are still a few desperate predictors whose opinions we take into account when compiling our forecasts. Therefore:

- despite EUR/USD’s rebound last week, the pair’s main trend of the last few months remains as is – down to 1.0000. (By the way, the downstream channel with all possible fluctuations is very clear on the H4 chart). The short-term upward trend may continue all the way to 1.0915-1.1040 at the start of the week, after which everything should return to normal;

- the GBP/USD pair is expected to fluctuate again just like EUR/USD while at the same time moving in a sideways corridor between 1.4700 and 1.5000 under bearish influence;

- unlike the Brit, the USD/JPY pair will, on the contrary, strive upwards and try to regain last week’s losses, the nearest target being 121.20. With this, neither the indicators nor the analysts rule out that over the first day or two the pair will still continue to fall;

- judging by the indicators, the forecast for USD/CHF is as follows: at first (but not for long) strictly downwards and then strictly upwards, back to the coveted mark of 1.0000. Considering that the transfer of Friday’s indications to Monday is not that wise, it is possible that the pair will turn around and move upwards straight away, from the first tick. The analysts in general support this.

As for last week’s forecast:

- the analysts’ predictions for EUR/USD’s tendency turned out to be right. They forecast that the pair would rebound upwards to 1.1000-1.1200. Truth be told, the pair didn’t reach this level after all, although at its peak the rebound made almost 600 points;

- regarding the GBP/USD pair, we predicted that the proud Brit will continue to trail the Euro. Just have a look at last week’s charts;

- the USD/JPY pair didn’t meet our expectations. As predicted, the first half of the week it stayed in a lulling sideways trend within the narrow range of 121.140-121.50 but on Wednesday evening’s news, instead of shooting upwards, it plunged breaking through the support around 120.65-120.80;

- as for USD/CHF, if its collapse in January was called “Black Thursday,” the events of last Wednesday can be safely dubbed “Dark Grey Wednesday.” We hope that the heavy clouds will disperse soon and the Swiss Frank will once again see the boundlessly blue Alpine skies.

Roman Butko, NordFX

- despite EUR/USD’s rebound last week, the pair’s main trend of the last few months remains as is – down to 1.0000. (By the way, the downstream channel with all possible fluctuations is very clear on the H4 chart). The short-term upward trend may continue all the way to 1.0915-1.1040 at the start of the week, after which everything should return to normal;

- the GBP/USD pair is expected to fluctuate again just like EUR/USD while at the same time moving in a sideways corridor between 1.4700 and 1.5000 under bearish influence;

- unlike the Brit, the USD/JPY pair will, on the contrary, strive upwards and try to regain last week’s losses, the nearest target being 121.20. With this, neither the indicators nor the analysts rule out that over the first day or two the pair will still continue to fall;

- judging by the indicators, the forecast for USD/CHF is as follows: at first (but not for long) strictly downwards and then strictly upwards, back to the coveted mark of 1.0000. Considering that the transfer of Friday’s indications to Monday is not that wise, it is possible that the pair will turn around and move upwards straight away, from the first tick. The analysts in general support this.

As for last week’s forecast:

- the analysts’ predictions for EUR/USD’s tendency turned out to be right. They forecast that the pair would rebound upwards to 1.1000-1.1200. Truth be told, the pair didn’t reach this level after all, although at its peak the rebound made almost 600 points;

- regarding the GBP/USD pair, we predicted that the proud Brit will continue to trail the Euro. Just have a look at last week’s charts;

- the USD/JPY pair didn’t meet our expectations. As predicted, the first half of the week it stayed in a lulling sideways trend within the narrow range of 121.140-121.50 but on Wednesday evening’s news, instead of shooting upwards, it plunged breaking through the support around 120.65-120.80;

- as for USD/CHF, if its collapse in January was called “Black Thursday,” the events of last Wednesday can be safely dubbed “Dark Grey Wednesday.” We hope that the heavy clouds will disperse soon and the Swiss Frank will once again see the boundlessly blue Alpine skies.

Roman Butko, NordFX

Generalized Forex Forecast for 30 March - 3 April 2015

Generalized Forex Forecast for 30 March - 3 April 2015

Generalizing the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, we have to mention that, according to the “open hands” symbol in the table, more than a third of the analysts are at a loss. However, the remaining experts are much more unanimous in their predictions than before:

- the forecast for EUR/USD remains the same – downwards trying to reach 1.0000 at least by the end of April. This week the pair may fall to around 1.0600-1.0750 where it will stabilize for some time;

- almost the same can be expected from the British Pound – most analysts predict GBP/USD would fall to 1.4700;

- as for USD/JPY, the forecasts of the analysts and of the indicators are contradictory. Yet, the pair is very likely to be in a bullish trend and try to conquer 120.50;

- just like last week, the USD/CHF chart may resemble that one of USD/JPY. In any case, all analysts expect USD/CHF to return to 1.0000. However, the forecast for this week is a bit more modest – a rise to 0.9750 or somewhat higher to 0.9800.

As for last week’s forecast:

- when predicting EUR/USD’s behaviour, we didn’t rule out a further short-term upward trend to around 1.0915-1.1040, after which everything was supposed to get back to normal. As expected, the pair quickly went up to 1.1030, entered a sideways trend, remaining strictly in the set bounds, and then predictably returned to the level of the beginning of the week;

- the forecast for GBP/USD was also confirmed – the pair stayed in the sideways corridor under bearish influence all week long;

- the predicted fall of USD/JPY got prolonged, and the pair started to recover its losses only last Thursday managing to rise just to the average level of February by the end of the week;

- a rare event occurred with the USD/CHF weekly chart basically repeating the USD/JPY chart, which overall matches the first scenario we suggested – at first the pair moves strictly downwards and then strictly upwards. With this, the upward movement doesn’t look too convincing so far and needs to be upheld this week.

Roman Butko, NordFX

- the forecast for EUR/USD remains the same – downwards trying to reach 1.0000 at least by the end of April. This week the pair may fall to around 1.0600-1.0750 where it will stabilize for some time;

- almost the same can be expected from the British Pound – most analysts predict GBP/USD would fall to 1.4700;

- as for USD/JPY, the forecasts of the analysts and of the indicators are contradictory. Yet, the pair is very likely to be in a bullish trend and try to conquer 120.50;

- just like last week, the USD/CHF chart may resemble that one of USD/JPY. In any case, all analysts expect USD/CHF to return to 1.0000. However, the forecast for this week is a bit more modest – a rise to 0.9750 or somewhat higher to 0.9800.

As for last week’s forecast:

- when predicting EUR/USD’s behaviour, we didn’t rule out a further short-term upward trend to around 1.0915-1.1040, after which everything was supposed to get back to normal. As expected, the pair quickly went up to 1.1030, entered a sideways trend, remaining strictly in the set bounds, and then predictably returned to the level of the beginning of the week;

- the forecast for GBP/USD was also confirmed – the pair stayed in the sideways corridor under bearish influence all week long;

- the predicted fall of USD/JPY got prolonged, and the pair started to recover its losses only last Thursday managing to rise just to the average level of February by the end of the week;

- a rare event occurred with the USD/CHF weekly chart basically repeating the USD/JPY chart, which overall matches the first scenario we suggested – at first the pair moves strictly downwards and then strictly upwards. With this, the upward movement doesn’t look too convincing so far and needs to be upheld this week.

Roman Butko, NordFX

NordFX Conquers a New Height – a Million Accounts!

NordFX Conquers a New Height – a Million Accounts!

The spring of 2015 has been marked by a milestone event for NordFX – the number of trading accounts in the company has reached 1,000,000!

Thousands of new accounts are registered in NordFX monthly as traders from various parts of the world give their preference to the company, choosing its high standards of quality and reliability.

Regardless of the deposit amount, every NordFX customer receives top-level service and access to the most advanced online trading technology and products on financial markets. A wide selection of trading account types, platforms and instruments, innovative autotrading and signal copying services – all that's required to make trading for both beginners and the experienced not just convenient but also highly profitable. A short while ago, our customers were granted another fantastic opportunity to build up their capital due to the launch of the platform for trading binary options.

Since day one of its existence, the cohesive NordFX team has been doing its best to meet the demands of even the most sophisticated customers, and we’re grateful to all who appreciate our efforts and have chosen NordFX as their trustworthy guide around the world of Forex.

Thank you for joining NordFX!

Thousands of new accounts are registered in NordFX monthly as traders from various parts of the world give their preference to the company, choosing its high standards of quality and reliability.

Regardless of the deposit amount, every NordFX customer receives top-level service and access to the most advanced online trading technology and products on financial markets. A wide selection of trading account types, platforms and instruments, innovative autotrading and signal copying services – all that's required to make trading for both beginners and the experienced not just convenient but also highly profitable. A short while ago, our customers were granted another fantastic opportunity to build up their capital due to the launch of the platform for trading binary options.

Since day one of its existence, the cohesive NordFX team has been doing its best to meet the demands of even the most sophisticated customers, and we’re grateful to all who appreciate our efforts and have chosen NordFX as their trustworthy guide around the world of Forex.

Thank you for joining NordFX!

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

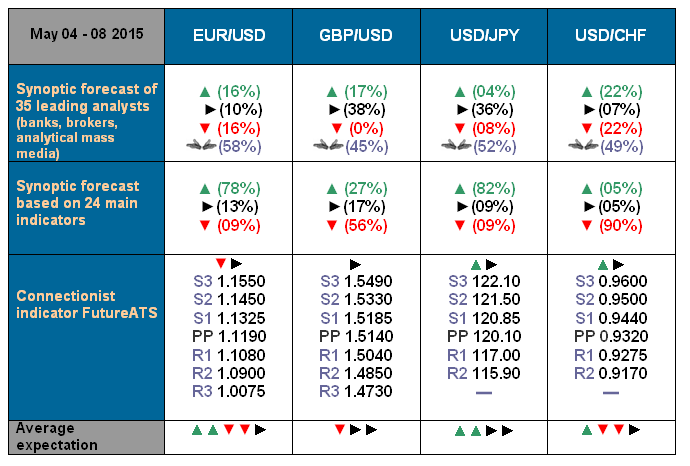

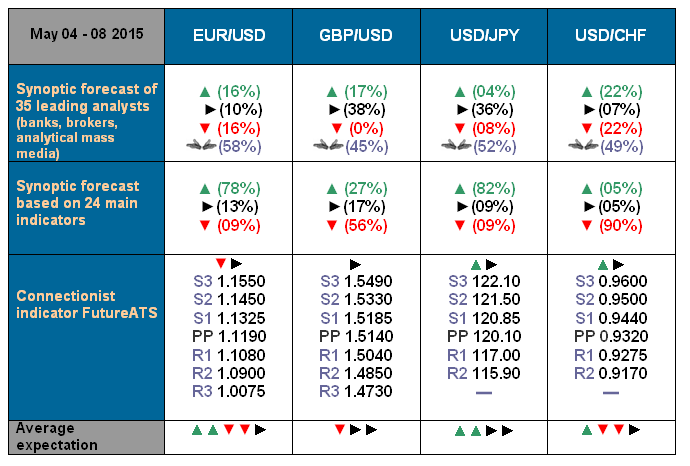

Generalized Forex Forecast for 4-8 May 2015

First, a few words regarding last week’s forecast:

- the forecast for EUR/USD was fulfilled by exactly 50%. As promised, at the start of the week the pair strived to the top boundary of the corridor, which was defined by the highs of March and April. However, after that, instead of rebounding and going downwards, the pair rushed further upwards and reached the level of February;

- GBP/USD was much more docile – it was rising for the first few days of the week but towards the end, as predicted, it rapidly rolled downwards and finished the five days where it had taken off;

- USD/JPY was predicted to continue its sideways trend and rise to around 120.80-122.00, which happened with 100% accuracy. The pair’s sideways movement with a 120.28 high is clearly seen on the H4 and D1 charts;

- on the contrary, the analysts’ forecast for USD/CHF turned out to be 100% inaccurate. The pair was expected to mirror the movements of EUR/USD and it did. Precisely due to this, USD/CHF went downwards, reaching the level of February just like EUR/USD.

- the EUR/USD pair will be in a sideways trend with fluctuations in the range of 1.1100-1.1430, although the pair may fall to 1.0800, returning to the low of last week;

- the majority of the analysts think that GBP/USD will also be in a sideways trend in the boundaries from 1.5000 to 1.5300. This forecast is supported by the discordance in the indicator readings;

- like last week, most of the analysts and 82% of the indicators presume that USD/JPY will try to consolidate in the range of 120.00-122.00, the high for the coming five days being at 121.50. On the other hand, 8% of the analysts predict a sharp rebound downwards and a fall to the level of 117.00;

- finally, USD/CHF is most likely to take after EUR/USD, same as last week. If the latter moves downwards, USD/CHF, mirroring EUR/USD, will go upwards to 0.9500. With this, if you calculate the mean maximum and minimum based on all the forecasts, the pair should finish the next week exactly at the same level it had started, i.e. at 0.9335.

Roman Butko, NordFX

First, a few words regarding last week’s forecast:

- the forecast for EUR/USD was fulfilled by exactly 50%. As promised, at the start of the week the pair strived to the top boundary of the corridor, which was defined by the highs of March and April. However, after that, instead of rebounding and going downwards, the pair rushed further upwards and reached the level of February;

- GBP/USD was much more docile – it was rising for the first few days of the week but towards the end, as predicted, it rapidly rolled downwards and finished the five days where it had taken off;

- USD/JPY was predicted to continue its sideways trend and rise to around 120.80-122.00, which happened with 100% accuracy. The pair’s sideways movement with a 120.28 high is clearly seen on the H4 and D1 charts;

- on the contrary, the analysts’ forecast for USD/CHF turned out to be 100% inaccurate. The pair was expected to mirror the movements of EUR/USD and it did. Precisely due to this, USD/CHF went downwards, reaching the level of February just like EUR/USD.

***

Now about the forecast for the coming week. Generalizing in a table the opinions of 35 analysts from world leading banks and broker companies as well as forecasts based on different methods of technical and graphical analysis, it can be suggested that:- the EUR/USD pair will be in a sideways trend with fluctuations in the range of 1.1100-1.1430, although the pair may fall to 1.0800, returning to the low of last week;

- the majority of the analysts think that GBP/USD will also be in a sideways trend in the boundaries from 1.5000 to 1.5300. This forecast is supported by the discordance in the indicator readings;

- like last week, most of the analysts and 82% of the indicators presume that USD/JPY will try to consolidate in the range of 120.00-122.00, the high for the coming five days being at 121.50. On the other hand, 8% of the analysts predict a sharp rebound downwards and a fall to the level of 117.00;

- finally, USD/CHF is most likely to take after EUR/USD, same as last week. If the latter moves downwards, USD/CHF, mirroring EUR/USD, will go upwards to 0.9500. With this, if you calculate the mean maximum and minimum based on all the forecasts, the pair should finish the next week exactly at the same level it had started, i.e. at 0.9335.

Roman Butko, NordFX

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

05.05.2015 06:40 GMT

A Slight Hike on Markets

On Monday, the world’s financial markets closed mainly on the rise, with the exception of the commodity market where the price of oil dropped a little.

In Europe as such, the British FTSE 100 grew 0.36 percent to 6985.95 points on Friday. On Monday, there was no trading on the London exchange due to a holiday. Also on Monday, the German DAX 30 advanced 1.57 percent up to 11,634.34 points, and the French CAC 40 gained 0.84 percent reaching 5,088.82 points.

European investors’ sentiment was influenced by the news about an interim agreement between Greece and its lenders.

The Russian market was closed for May Day holidays on Monday.

In the USA, the Dow Jones grew 0.26 percent to 18,070.40 points, the S&P 500 gained 0.29 percent up to 2,114.49 points, and the NASDAQ added 0.23 percent getting to 5,016.93 points.

Oil prices, however, posted a slight drop yesterday. The NYMEX price of WTI oil futures for June went down by $0.22 and reached $58.93 a barrel. On London’s ICE, the cost of Brent oil futures for June delivery was down by $0.01 ending up at $66.45 a barrel.

On the Forex market, EUR/USD is returning to the breakthrough point in the double bottom pattern on the daily chart. The pair may start moving up again from 1.0970.

Anna Gorenkova

NordFX Analyst

A Slight Hike on Markets

On Monday, the world’s financial markets closed mainly on the rise, with the exception of the commodity market where the price of oil dropped a little.

In Europe as such, the British FTSE 100 grew 0.36 percent to 6985.95 points on Friday. On Monday, there was no trading on the London exchange due to a holiday. Also on Monday, the German DAX 30 advanced 1.57 percent up to 11,634.34 points, and the French CAC 40 gained 0.84 percent reaching 5,088.82 points.

European investors’ sentiment was influenced by the news about an interim agreement between Greece and its lenders.

The Russian market was closed for May Day holidays on Monday.

In the USA, the Dow Jones grew 0.26 percent to 18,070.40 points, the S&P 500 gained 0.29 percent up to 2,114.49 points, and the NASDAQ added 0.23 percent getting to 5,016.93 points.

Oil prices, however, posted a slight drop yesterday. The NYMEX price of WTI oil futures for June went down by $0.22 and reached $58.93 a barrel. On London’s ICE, the cost of Brent oil futures for June delivery was down by $0.01 ending up at $66.45 a barrel.

On the Forex market, EUR/USD is returning to the breakthrough point in the double bottom pattern on the daily chart. The pair may start moving up again from 1.0970.

Anna Gorenkova

NordFX Analyst

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

06.05.2015 07:30 GMT

Yesterday world financial markets closed mixed. European indices posted a drop – Britain’s FTSE 100 fell 0.84 percent to 6,927.58 points, Germany’s DAX slumped 2.51 percent down to 11,327.68 points, and France’s CAC 40 dropped 2.12 percent down to 4,974.07 points.

At the same time, Russia’s equity soared up, taking a cue from rising oil prices and ruble strengthening over the holidays. Thus, the MICEX index advanced 1.98 percent up to 1,721.80 points while the RTS index shot up by 4.24 percent altogether and reached 1,072.93 points.

In the USA, the Dow Jones fell 0.79 percent to 17,928.20 points, the S&P 500 shed 1.18 percent down to 2,089.46 points, and the NASDAQ dropped 1.55 percent down to 4,939.33 points.

On the NYMEX, the price of June futures for WTI oil rose by $1.47 and made $60.40 a barrel. On London’s ICE, the June future for oil of mark Brent went up by $1.07 and reached $67.52 a barrel.

Yesterday on the global currency market, the euro gained ground against the dollar. Today EUR/USD continues to go up. In case the chart pattern is completed, the pair can get to 1.14.

Anna Gorenkova

NordFX Analyst

Russian Equity Gains Due to Oil Price Rise Over Holidays

Yesterday world financial markets closed mixed. European indices posted a drop – Britain’s FTSE 100 fell 0.84 percent to 6,927.58 points, Germany’s DAX slumped 2.51 percent down to 11,327.68 points, and France’s CAC 40 dropped 2.12 percent down to 4,974.07 points.

At the same time, Russia’s equity soared up, taking a cue from rising oil prices and ruble strengthening over the holidays. Thus, the MICEX index advanced 1.98 percent up to 1,721.80 points while the RTS index shot up by 4.24 percent altogether and reached 1,072.93 points.

In the USA, the Dow Jones fell 0.79 percent to 17,928.20 points, the S&P 500 shed 1.18 percent down to 2,089.46 points, and the NASDAQ dropped 1.55 percent down to 4,939.33 points.

On the NYMEX, the price of June futures for WTI oil rose by $1.47 and made $60.40 a barrel. On London’s ICE, the June future for oil of mark Brent went up by $1.07 and reached $67.52 a barrel.

Yesterday on the global currency market, the euro gained ground against the dollar. Today EUR/USD continues to go up. In case the chart pattern is completed, the pair can get to 1.14.

Anna Gorenkova

NordFX Analyst

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

08.05.2015 07:30 GMT

EUR/USD Is Correcting

Yesterday world financial markets posted mixed results again. In Europe, the FTSE 100 fell 0.67 percent to 6,886.95 points, the DAX grew 0.51 percent to 11,407.97 points while the САС 40 shed 0.29 percent down to 4,967.22 points.

Russia’s indices went down following oil prices – the MICEX index dropped 1.59 percent to 1,686.98 points, and the RTS index fell 0.51 percent to 1,060.73 points.

In the USA, the Dow Jones added 0.46 percent making 17,924.06 points, the S&P 500 grew 0.38 percent to 2,088 points, and the NASDAQ advanced 0.53 percent up to 4,945.54 points.

Thursday evening oil prices went down. The NYMEX price of WTI oil futures for June dropped by $1.71 and reached $56.59 a barrel. On London’s ICE, the price of the Brent oil future for June was down by $2.03 and got to $65.74 a barrel.

On the global currency market, EUR/USD was slightly short of the 1.14 target and is experiencing a downward correction. Nonetheless, in case of favorable macroeconomic data, the pair may reach 1.1470.

Anna Gorenkova

NordFX Analyst

EUR/USD Is Correcting

Yesterday world financial markets posted mixed results again. In Europe, the FTSE 100 fell 0.67 percent to 6,886.95 points, the DAX grew 0.51 percent to 11,407.97 points while the САС 40 shed 0.29 percent down to 4,967.22 points.

Russia’s indices went down following oil prices – the MICEX index dropped 1.59 percent to 1,686.98 points, and the RTS index fell 0.51 percent to 1,060.73 points.

In the USA, the Dow Jones added 0.46 percent making 17,924.06 points, the S&P 500 grew 0.38 percent to 2,088 points, and the NASDAQ advanced 0.53 percent up to 4,945.54 points.

Thursday evening oil prices went down. The NYMEX price of WTI oil futures for June dropped by $1.71 and reached $56.59 a barrel. On London’s ICE, the price of the Brent oil future for June was down by $2.03 and got to $65.74 a barrel.

On the global currency market, EUR/USD was slightly short of the 1.14 target and is experiencing a downward correction. Nonetheless, in case of favorable macroeconomic data, the pair may reach 1.1470.

Anna Gorenkova

NordFX Analyst

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

GENERALIZED FOREX FORECAST FOR 11 – 15 MAY 2015

«BINGO!” AND BLACK BEARS

As usual, first a few words regarding last week’s forecast:«BINGO!” AND BLACK BEARS

- for the EUR/USD pair the forecast was fulfilled by no less than 100%. We supposed that the EUR/USD pair would experience a sideways trend and a possible descent to the 1.0800 mark. This is what actually ended up happening, as on Tuesday the pair fell into the 1.0700÷1.0850 zone and stayed there for approximately one hour before determinedly rising in order to finish the week at exactly the same mark as the mark it started from;

- the GBP/USD pair was strictly abiding by our “guidelines” of a sideways move all week until Thursday evening, maintaining an even narrower range than we originally supposed. However, this was followed by the announcement of the British election results, which surprised not only politicians but also financiers, resulting in the pair soaring up by more than 200 points

- Regarding the USD/JPY pair, the majority of both analysts and indicators asserted that the pair would keep strengthening in the area above 120.00. On the other hand, a rather tight-numbered opposition was foretelling a rapid downwards rebound. The result was that both groups proved to be right, as at the start of the week “bulls” were propping the pair up, not letting it fall below the arranged 120.00 line. However, they then weakened and passed on their influence to the “bears”. Zoologists claim that Japanese black bears prefer steep mountainous terrain, which, judging by the way the pair impetuously descended, is hard to disagree with. However, by the end of the week, the pair once again climbed upwards, returning to the 119.70 point, which it has been fluctuating about since the end of March.

- The USD/CHF forecast maintained that the pair would continue following in the wake of EUR/USD, acting as a mirror image of its “older sister”. Therefore, , looking at last week’s charts we can now shout “Bingo!”, since the forecast proved to be 100% accurate.

***

Now on to the forecast for the upcoming week. Aggregating the opinions of 35 analysts from the world’s leading banks and brokerage firms, as well as forecasts, which were based on an extremely diverse range of technical and graphical analytical methods, we can presume that:

- The EUR/USD pair will most likely continue occupying a sideways trend with fluctuations about the 1.1230 mark. At the very least, this is the conclusion we arrived at after looking at the neat split between expert opinions: ↑ - 22%, → - 3%, ↓- 19%, ↔ (raised hands) – 56%. A similar situation occurs with indicator showings: ↑ - 35%, → - 17%, ↓- 48%. The main levels of support 1.1060, 1.0850 and 1.0650, whilst the main levels of resistance are 1.1290 and 1.1440;

- For the GBP/USD pair an absolute majority of indicators (87%. ) on both H4 and D1 foretell growth. Analysts’ opinions, however, diverge (↑ - 25%, → - 9%, ↓- 22%, ↔ – 44%. ). Since the pair has already reached quite a high level of 1.5600, there exists a significant probability that the pair will attempt to barge through the resistance and settle in the 1.5475÷1.5785 zone. However, a failure to do so and an ensuing descent to the 1.5000 support level can also be predicted with a similarly high probability.

- As for the USD/JPY pair, expert opinions and indicator predictions also diverge (experts: ↑ - 7%, → - 22%, ↓- 26%, ↔ – 45%, indicators: ↑ - 60%, → - 17%, ↓- 23%. ). However, both are satisfied with a Pivot Point level of 119.70, support at the 119.20, 188.75 and 119.20 levels and resistance at 120.05, 120.30 и 120.85;

- Regarding the near future of the USD/CHF pair, however, both analysts and indicators are in harmony: more than 75% of the former and 56% of the latter agree that the pair should rise and settle in the 0.9300÷0.9400 corridor. The next support level is 0.9190 and the next resistance level is 0.9500.

Roman Butko, NordFX

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

Re: NordFX.com - ECN/STP, MT4, MT5, Multiterminal broker

13.05.2015 08:10 GMT